Weekly digest - September 13 2023

|

TALKING POINTS

AVCJ AWARDS 2023 - NOMINATIONS CLOSE SEPTEMBER 22

Industry participants have until September 22 to put forward the firms, fundraises, investments, and exits they believe worthy of consideration. For more information, go to www.avcjforum.com/awards

|

|

By the Numbers

AVCJ RESEARCH

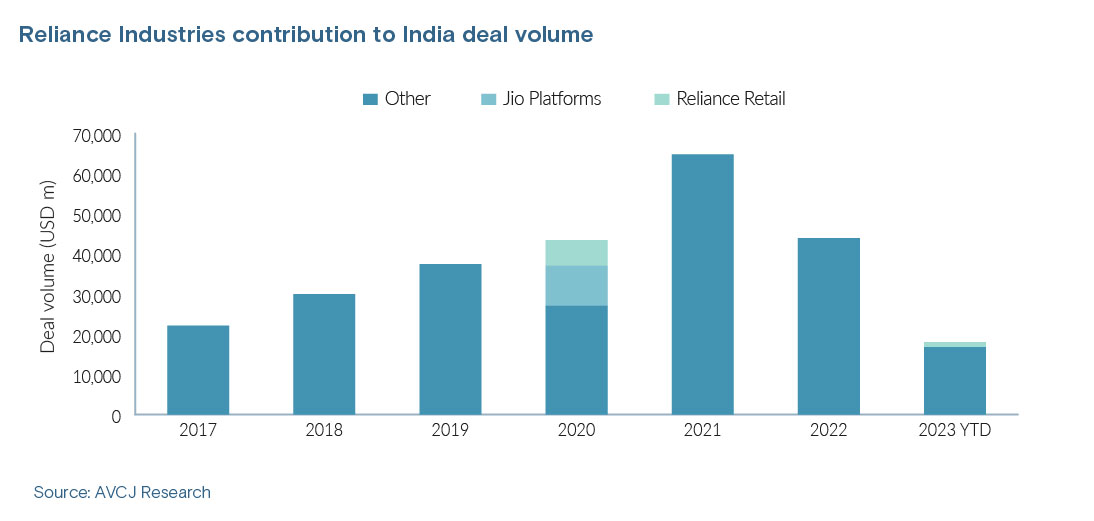

THE RELIANCE EFFECT

Reliance Industries has an ambitious plan to digitalise India's consumer sector and plenty of PE investors are backing the domestic behemoth to push it through.

Jio Platforms – the holding company for a range of apps, some nascent broadband and cable services, and India's leading mobile carrier – is responsible for the demand side, packaging e-commerce into a broader digital offering. Reliance Retail is tasked with transforming the supply side by helping 20m merchants apply technology solutions to retail processes and supply chain infrastructure. When these businesses last came to market in 2020, they collected USD 9.9bn and USD 6.4bn, respectively, mostly global GPs and sovereign wealth funds. The two companies accounted for more than one-third of all PE investment in India that year. The 2020 total of USD 43.4bn was bettered in 2021 and 2022 without any assistance from Reliance Industries. Now, though, the behemoth is back, securing USD 1bn from Qatar Investment Authority (QIA) and USD 250m from KKR. The pre-money valuation of USD 100bn is double what it was in the previous round. It is said to be part of the preparation for a domestic IPO. Reliance Retail reportedly wants to raise USD 2.5bn in total, a fraction of its last round, but potentially a sizeable chunk of a relatively slow year for private equity investment.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.