Weekly digest - September 06 2023

|

By the Numbers

AVCJ RESEARCH

CHINA IN SIX TRENDS

To mark the AVCJ Private Equity & Venture Forum China 2023, which has been taking place this week (for more, see the China special issue)...

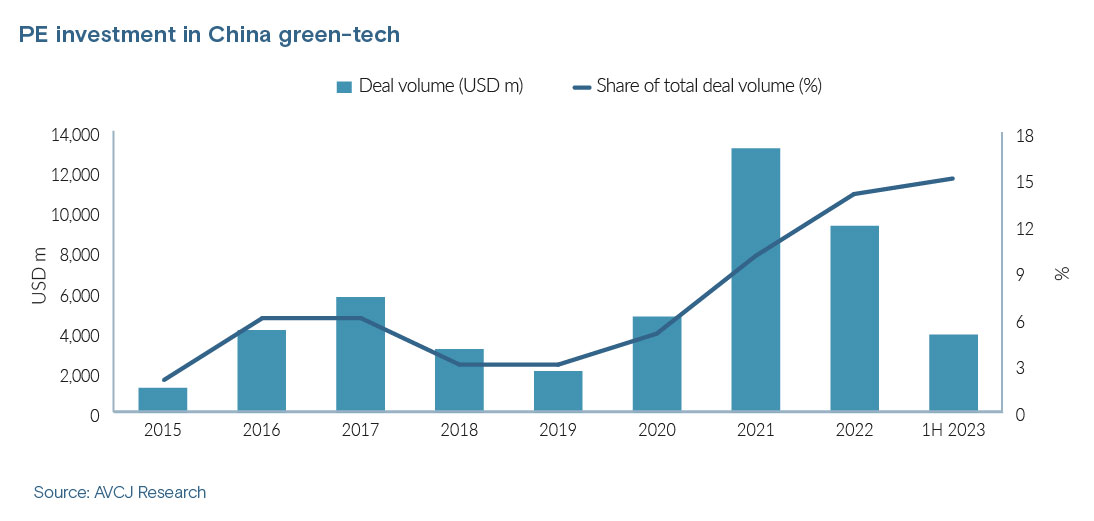

1. The best fundraising strategy for China GPs appears to be delaying a return to market as long as possible. In addition to global challenges, China is plagued by a string of local ones as well: a retreat from emerging markets, US investors hindered by geopolitical tensions, a recent history of regulatory volatility, and a longer history of valuation mark-ups not crystallizing into distributions. 2. Investment in technology across all stages fell by 60% last year, but deployment was still more than the next two largest sectors combined (healthcare and transportation and distribution). This is unlikely to be repeated in 2023. Technology currently leads healthcare with USD 7.1bn to USD 4.5bn. 3. Interest in green-tech has surged as investors target sectors expected to benefit from policy tailwinds in China. Investment has fallen from the 2021 peak of USD 13.1bn – to USD 9.3bn in 2022 and USD 3.8bn year-to-date. But the green-tech share of deal volume over these three years has risen from 10% to 14.2% to 15.3%. 4. China's white-hot semiconductor industry appears to have cooled in the eyes of PE and VC investors. Early and growth-stage deal flow more than doubled to USD 11.2bn in 2022, buoyed by the import substitution theme. Yet deployment for 2023 to date is USD 2.2bn amid talk of valuation corrections for previously high-flying chip designers. 5. Two deals – Fortune COFCO and Shein – account for one-fifth of the USD 25.3bn invested in China so far this year. Fortune COFCO, which received CNY 21bn (USD 3.1bn) from various state-linked investors is more reflective of the market. Nine of the country's top 12 deals were completed by renminbi-denominated pools of capital. 6. China is poised for one its worst years on record for exits. Proceeds amount to less than USD 1bn – compared to 12-month totals of USD 5.3bn in 2022 (a 14-year low). The picture for PE-backed IPOs isn't so bleak, with proceeds of USD 24.4bn from 111 offerings in the first eight months. The caveat is that you need to list domestically.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.