Weekly digest - August 30 2023

|

By the Numbers

AVCJ RESEARCH

AUSTRALIA UNBLOCKED

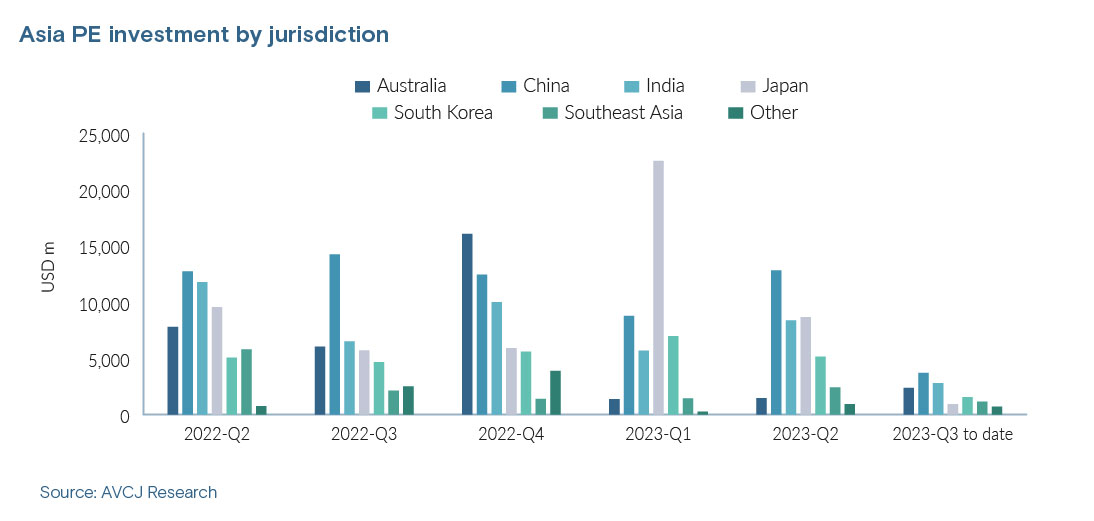

With one month of the third quarter to go, private equity investors have deployed approximately USD 13bn in Asia, according to provisional data from AVCJ Research. Matching the USD 39.8bn put to work between April and June seems a tall order.

Activity is weak in all major markets – apart from one. Australia has seen USD 2.4bn in private equity investment so far this quarter, already bettering the second-quarter total of USD 1.5bn. It is responsible for two of the three largest deals announced: Zimmerman (Advent International, USD 1bn) and Australian Venue (PAG, USD 900m). The revival is largely driven by long-simmering buyouts finally coming to the boil. Obstacles have been removed – whether it was insufficient leveraged financing, differences in valuation expectations, or uncertainty around post-pandemic performance data – which should encourage dealmakers. Australian Venue is a case in point. The company owns a portfolio of pubs, bars, and restaurants that KKR has assiduously expanded over the course of six years, COVID-19 notwithstanding. BGH Capital was close to buying the asset last year, but the deal stumbled at the last. Now PAG has moved in. Two sizeable take-private situations also came to fruition, in each case after an approximately five-month pursuit. Bain Capital won board approval for a AUD 959m (USD 630m) acquisition of aged care provider Estia Health and then TPG Capital made a AUD 2.2bn breakthrough funeral services player Invocare.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.