Weekly digest - August 02 2023

|

The AVCJ weekly digest will return on August 23

|

|

By the Numbers

AVCJ RESEARCH

BEATING THE TRAFFIC

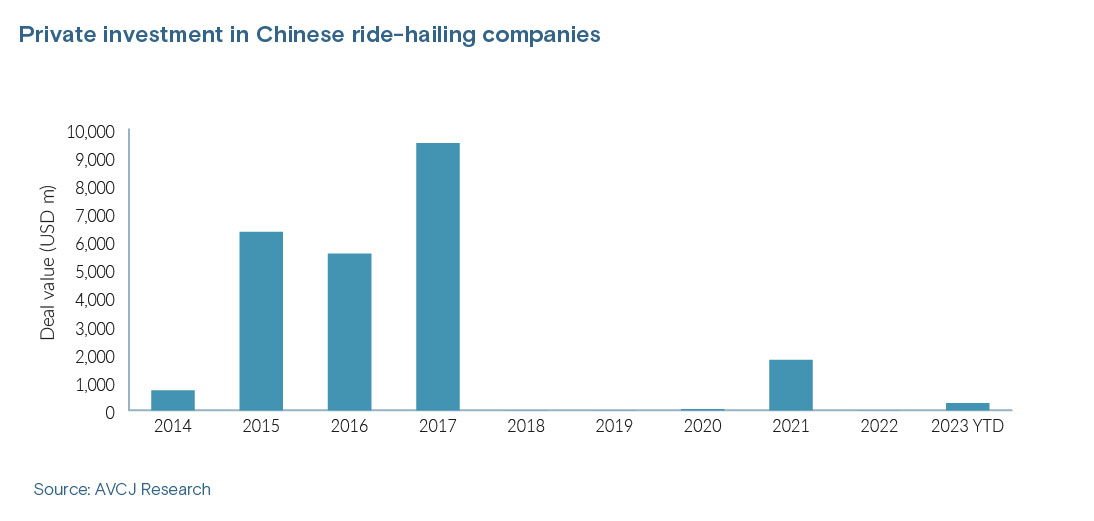

The investigation that followed Didi Chuxing's IPO in mid-2021 cast fear into Chinese companies targeting US listings. But for up-and-comers in the ride-hailing space, the accompanying halt on Didi registrations and app downloads imposed by regulators was a window of opportunity. T3 Go and Caocao Chuxing went on a fundraising spree.

It doesn't compare to the mid-2010s arms race that saw Didi Dache, Kuaidi Dache, and Uber China raise capital with one hand and spend it on driver subsidies with the other. More than USD 21bn was committed to ride-hailing platforms between 2015 and 2017. During this period, Didi and Kuaidi merged and then bought Uber China, creating a market leader with scale to withstand any challenge. Or so it was thought. Meituan, Gaode, Haro, and Dida Chuxing were said to be seeking to capitalise on Didi's misfortune in 2021. T3 made little secret of its ambitions on closing a CNY 7.7bn (USD 1.2bn) Series A. Caocao earlier raised CNY 3.8bn. These rounds accounted for almost all the USD 1.8bn that went to ride-hailing platforms in 2020 and 2021. Activity coincided with the peak of China's investment boom and the subsequent slump hasn't been kind to any tech-enabled company with an aggressive loss-leading business plan. However, Ruqi Mobility and T3 recently returned to market, with one securing CNY 842m and the other getting CNY 1bn. Whether they have realistic hopes of toppling Didi may not be the point. These newcomers have strong strategic backing: FAW Group, Dongfeng Motor, and Changan Auto provided angel funding for T3 with support from Alibaba Group and Tencent Holdings; Caocao is controlled by Geely; and Ruqi was incubated by GAC Group. So, the spate of investment offers insighs into how China's automakers envisage a future beyond internal combustion engines. These companies aspire to competency in electric vehicles (EVs) and autonomous driving, and they want to provide control services that feed and feed off the commercialisation of such technologies. T3, which wants to have 1,000 autonomous vehicles on the road by 2026, has outlined plans to leverage ride-hailing to build a travel ecosystem based on new energy and intelligence. Caocao is one of several Geely units to raise third-party funding. Others focus on EVs and electric vertical take-off and landing (eVTOL) vehicles.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.