Weekly digest - July 19 2023

|

By the Numbers

AVCJ RESEARCH

A SWING TO SPECIALITY PLAYERS

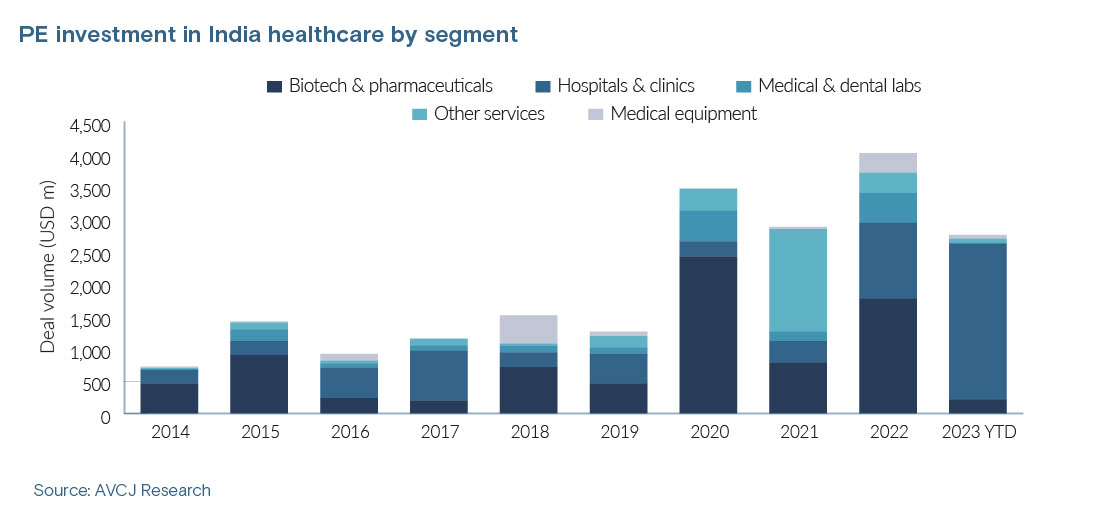

Private equity investment in India's healthcare sector took off in 2020. It hit USD 3.5bn that year, having never previously surpassed USD 2bn, and has remained above USD 2.5bn ever since.

There are various contributing factors: rising household incomes; an increase in US Food & Drug Administration-approved drug facilities helping tip the global active pharmaceutical ingredients market from China towards India; and COVID-19 exposing the need for greater investment in the country's healthcare infrastructure. Over half the capital entering the sector since 2022 – including almost everything deployed this year to date – has targeted hospitals. While not a new investment theme, it appears to have regained the initiative from biotech and pharmaceuticals. Bumper deals like the USD 1.9bn Temasek Holdings pumped into Manipal Health Enterprises in April move the needle. However, there have also been more nuanced plays such as Quadria Capital's recent USD 155m investment in Maxivision Eye Hospital, which runs 42 eye hospitals and vision clinics. This points to a maturation in private equity targeting, with single specialty healthcare providers increasingly on the agenda. It is the third India eyecare investment in the past 18 months, following a USD 188m commitment to ASG Eye Hospital and TPG Growth and Temasek pumping USD 136m into Dr. Agarawl's Eye Hospital.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.