Weekly digest - July 12 2023

|

By the Numbers

AVCJ RESEARCH

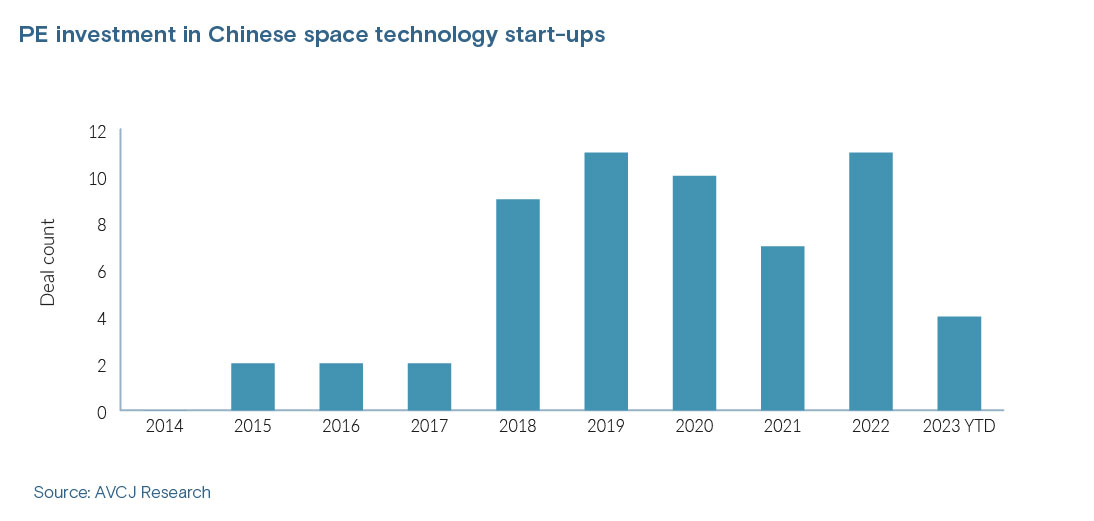

SPACE COWBOYS?

Space Pioneer hailed the successful maiden voyage of Tianlong II in April as the first time a privately-owned, liquid-fuelled rocket had reached orbit on a debut flight from China. Last week, Boyu Capital led a Series C for the company amounting to several hundred million renminbi.

There were four PE and VC investments into Chinese space technology companies – working under a somewhat restrictive definition of rocket developers and satellite builders – in the first half of 2023, according to AVCJ Research. Space Pioneer makes five, which suggests full-year deal count could exceed the seven posted in 2021, if not the record-equalling 11 in 2022. Prior to 2015, there were barely any investments at all. Activity only really took off in 2018, partly on the coattails of pioneers like LandSpace, OneSpace, and I-Space. They remain the industry's best-funded start-ups. Of the 78 Chinese commercial space companies tracked by the US-based Institute for Defense Analyses as of year-end 2018, four in five were less than three years old. Intensifying US-China technology competition has given the industry extra edge (although no access to foreign capital). Satellite internet was classified as new infrastructure in 2020, opening the door to greater policy support. China wants the private sector to catch up with the likes of US-based SpaceX, which plans to launch as many as 42,000 satellites into near-earth orbit. By industry standards, Space Pioneer is relatively mature with CNY 3bn (USD 416m) raised to date across multiple funding rounds. It is one of five companies for which AVCJ Research has captured at least five funding rounds – and these players account for more than half of the investments received by the industry. China space tech has a long tail of sparsely backed, barely proven start-ups.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.