Weekly digest - June 28 2023

|

By the Numbers

AVCJ RESEARCH

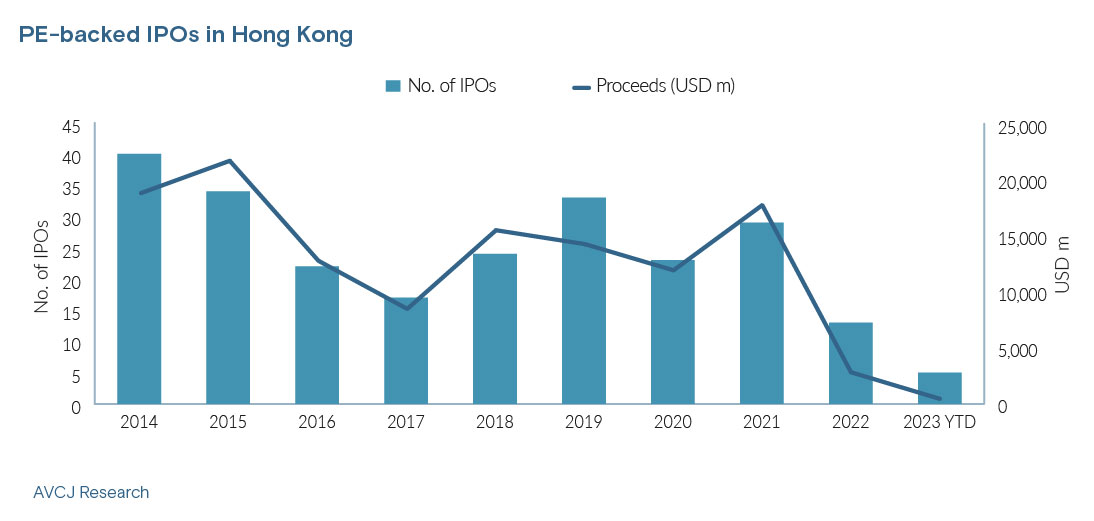

LIQUIDITY VIA HONG KONG

Between 2014 and 2021, an annual average of 28 private equity-backed companies went public on the Hong Kong Stock Exchange. Amid volatility in global equity markets and uncertainty around China, barely a handful of listings were completed in 2022, according to AVCJ Research. Now, though, we appear to be witnessing the makings of a rebound. There have been five IPOs year-to-date and new filings are coming.

O2O retail platform Dmall and e-commerce software-as-a-service (SaaS) provider Jushuitan have both unveiled Hong Kong listing plans in the past fortnight. They are the latest in a line of financial sponsor-supported companies that includes Lalatech Holdings, the parent delivery platform Lalamove. There are also high hopes for IPOs by Alibaba Group spinouts, starting with Cainiao Smart Logistics Group. Success is not guaranteed. Plenty of filings have yet to progress to IPO and the investor response to some listings has been muted. For example, human resources SaaS player Beisen Holdings raised HKD 238.9m (USD 30m) in April, but the stock has since lost 70% in value. Its market capitalisation is now HKD 6.3bn (USD 803m) – the most recent private round in 2021 valued the company at USD 1.86bn. Nevertheless, activity appears to be moving in the right direction. The exchange is doing its part too: earlier this year, listing requirements were loosened to allow pre-profit technology companies to go public with market capitalisations as low as HKD 6bn. Previously, pre-profit players made to the bourse by virtue of waivers generally awarded only to businesses of significant size.stomers.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.