Weekly digest - June 21 2023

|

By the Numbers

AVCJ RESEARCH

A LENS ON INDIA

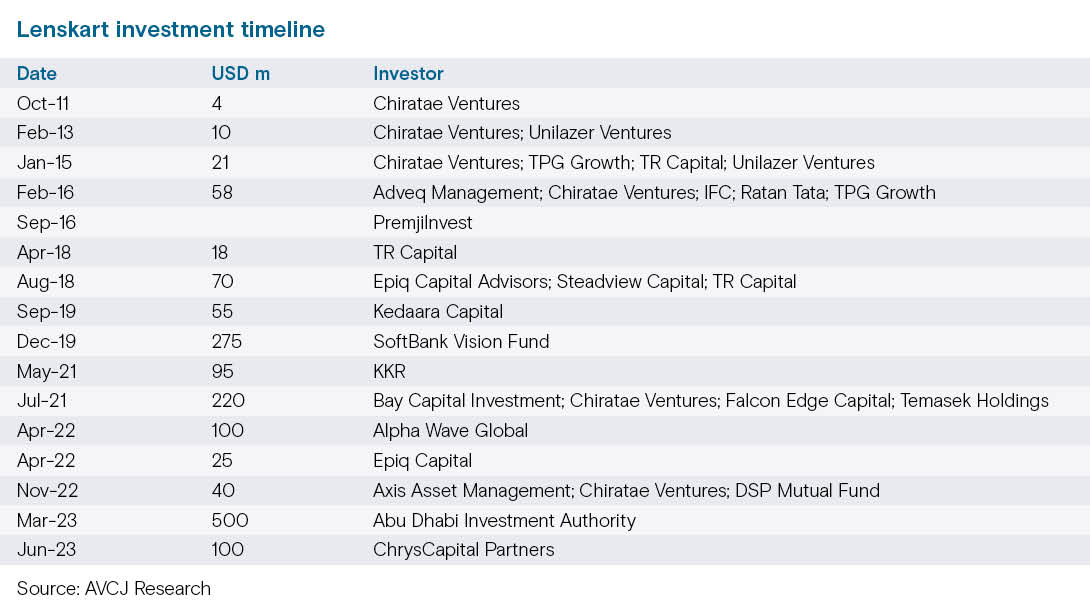

ChrysCapital's USD 100m investment in eyewear retailer Lenskart is emblematic of the Indian private equity firm's push into the new economy space. Dream Sports, FirstCry, and Xpressbees have all been added to the portfolio over the past 12 months, and like Lenskart, these are not early-stage bets – the targets have achieved a level of maturity.

Indeed, Lenskart has already graduated to cross-border M&A. Last year, it paid USD 300m in cash for Japanese counterpart Owndays, creating an overall footprint of more than 2,000 stores across Asia and the Middle East. It could be argued that Lenskart has emerged as a posterchild for the private equity ecosystem in India, graduating from early-stage to growth-stage rounds and allowing smaller backers to realise returns along the way. The ChrysCapital round, like several before it, featured a combination of primary and secondary shares. Secondaries specialist TR Capital was taking out existing positions as early as 2015. AVCJ Research has records of 16 Lenskart deals, including full institutional rounds and stand-alone strategic investments. Chiratae Ventures became the company's first backer in 2011 and has re-upped multiples times, tracking Lenskart across several funds. TPG Growth brought global attention in 2015 and the momentum continued. Other notable entries include SoftBank Vision Fund in 2019, KKR in 2021, and Abu Dhabi Investment Authority earlier this year. The latter picked up a 10% stake at a valuation of USD 5bn. Lenskart claims to be Asia's largest omnichannel glasses and contact lens retailer with some 20m customers.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.