Weekly digest - June 14 2023

|

By the Numbers

AVCJ RESEARCH

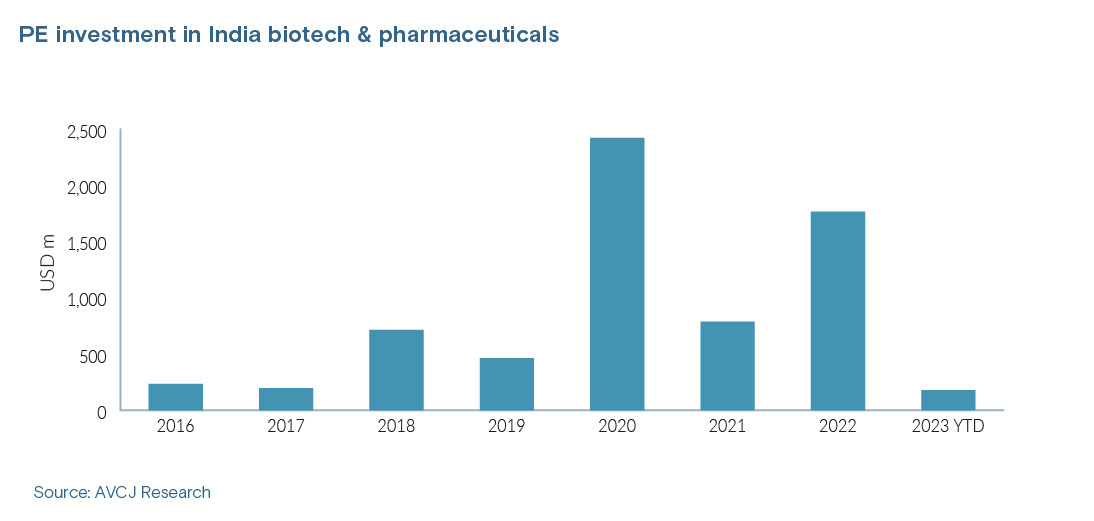

FANS OF PHARMA

PAG has completed its fourth India pharmaceuticals deal in four years, with a USD 200m commitment to generic drug maker RK Pharma. It follows the acquisition of contract drug manufacturer Acme Foundation for USD 145m and investments in Anjan Drug and Optimus Drugs. The latter two transactions were part of a joint India pharmaceuticals platform play with local GPs CX Partners and Samara Capital.

India's downstream pharmaceuticals industry has attracted more attention from private equity in recent years. Investors cite two key factors: the US Food & Drug Administration (FDA) setting up an Indian office in 2008 and then diving deeper into compliance issues; and the domestic API niche gaining traction as China's pollution control measures have chipped away at its dominance as a global pharma exporter. Investment in the space has been relatively slow year to date – consistent with most geographies and sectors in Asia – but USD 4.9bn was put to work in pharmaceuticals and biotech between 2020 and 2022, compared to USD 1.3bn in the three years prior. Activity has been punctuated by a relatively concentrated number of large-cap deals, typically involving global or pan-regional financial sponsors. Advent International's USD 1.15bn acquisition of Suven Pharmaceuticals in late 2022 is one example. Others include KKR's buyout of JB Chemicals & Pharmaceuticals and The Carlyle Group's commitment to Piramal Healthcare.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.