Weekly digest - June 07 2023

|

By the Numbers

AVCJ RESEARCH

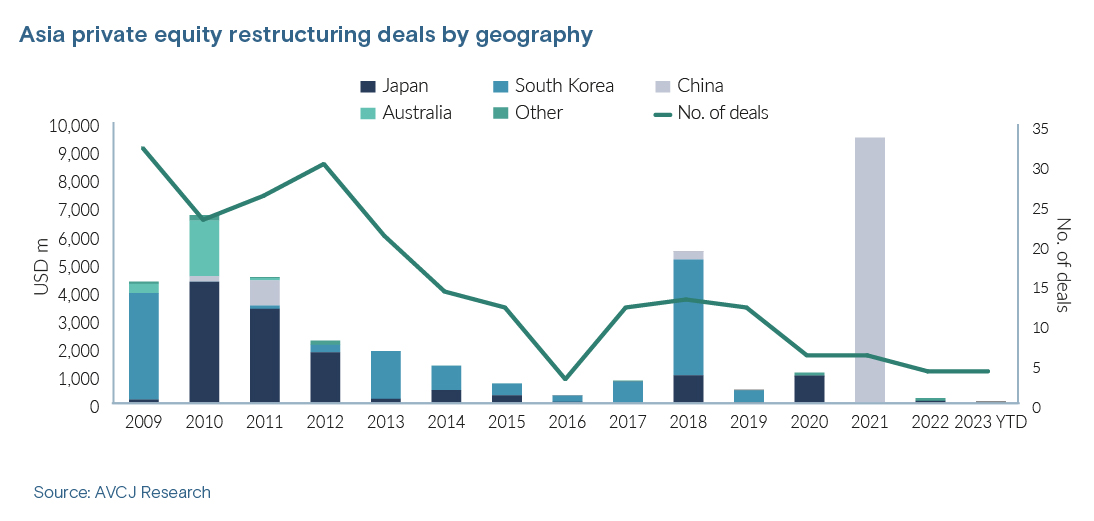

RESTRUCTURING REVIVAL?

Distress situations have been delayed – arguably for years – across Asia by an accommodating policy environment. As the effects wear off, there is mounting real and anecdotal evidence of corporate strife, from start-ups folding to mature companies struggling with debt burdens.

GenesisCare, an Australia-headquartered cancer care provider backed by private equity, recently filed for bankruptcy protection in the US – an apparent consequence of difficult market conditions and an aggressive US expansion plan. Investors in Real Pet Food, another Australian company, injected additional equity to appease lenders following a covenant breach. And NestAway, an Indian apartment rental start-up once valued at USD 220m was sold for a fraction of that sum. Only GenesisCare is on the cusp of formal restructuring; the other two situations are essentially bailouts for companies that might otherwise have sunk further. Restructuring deal flow involving private equity investors increased markedly in the post-global financial crisis years, with more than 130 transactions worth a combined USD 19.3bn announced between 2009 and 2013, according to AVCJ Research. Developed markets – with more reliable bankruptcy regimes and legal systems – like Korea, Japan, and Australia came to the fore. During the subsequent five years, USD 8.1bn was put to work across about 50 deals. Nearly half of that USD 8.1bn came from a single deal – Hahn & Company's restructuring of SK Shipping in 2018. Much the same happened in 2021 when almost all the USD 9.4bn invested went into Chinese semiconductor giant Tsinghua Unigroup. The coming months may see increased activity, but that won't necessarily capture the full extent of corporate weakness. There will be plenty of situations – indeed, special situations – where investors rescue companies before they toppled over the brink.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.