Weekly digest - May 31 2023

|

By the Numbers

AVCJ RESEARCH

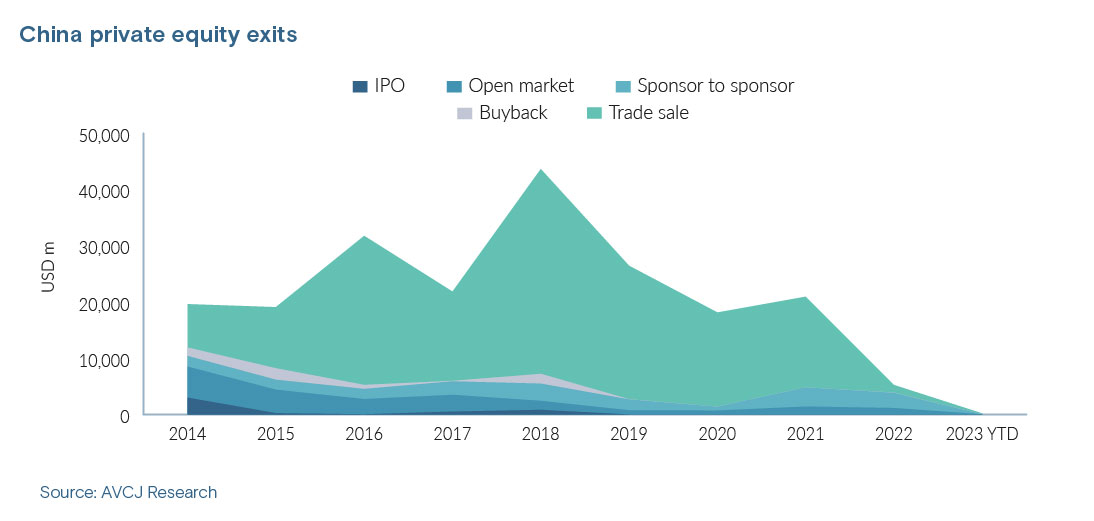

EXITS GRIDLOCK

China Youzan, an e-commerce software-as-a-service (SaaS) business, represents one of the more protracted and complex private equity exit stories in the region. The company received several rounds of funding in the early to mid-2010s – from investors that might have been expecting it to follow the standard offshore IPO route.

Instead, China Youzan was acquired by Hong Kong-listed China Innovationpay Group in 2018. This listed entity was renamed China Youzan and the e-commerce SaaS operating business, Youzan Technology, became its key subsidiary. It was an all-share deal, with investors in the start-up swapping some of their equity for shares in the listed entity. They still owned a significant piece of Youzan Technology directly. Part two of what had effectively become a trade sale appears to have been thwarted by COVID-19 and global tech selloffs. China Youzan stock peaked at HKD 4.19 in 2021 but then fell sharply, reaching HKD 0.07 in late 2022. A founder-led take-private bid for China Youzan – which included a proposal to divvy up shares in the Youzan Technology, essentially creating a standalone business – failed in 2021. Now, though, there has been a breakthrough. China Youzan has agreed to take full control of Youzan Technology for HKD 2.6bn (USD 334.5m), creating a liquidity event for the likes of Hillhouse Capital, Matrix Partners China, and Gaocheng Capital. They will receive yet more China Youzan stock. The resolution coincides with efforts to stabilise China Youzan's business, notably a raft of cost-cutting measures, including job cuts, that ended years of escalating losses. Assuming the investors' now liquid positions can turn into distributions, it would add a touch of much-needed gloss to a bleak environment. In the eight years to 2021, annual average exit proceeds from private equity-backed Chinese companies amounted to USD 25.1bn. Proceeds feel to USD 5.2bn in 2022 and the first few months of 2023 have been little better.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.