Weekly digest - May 24 2023

|

By the Numbers

AVCJ RESEARCH

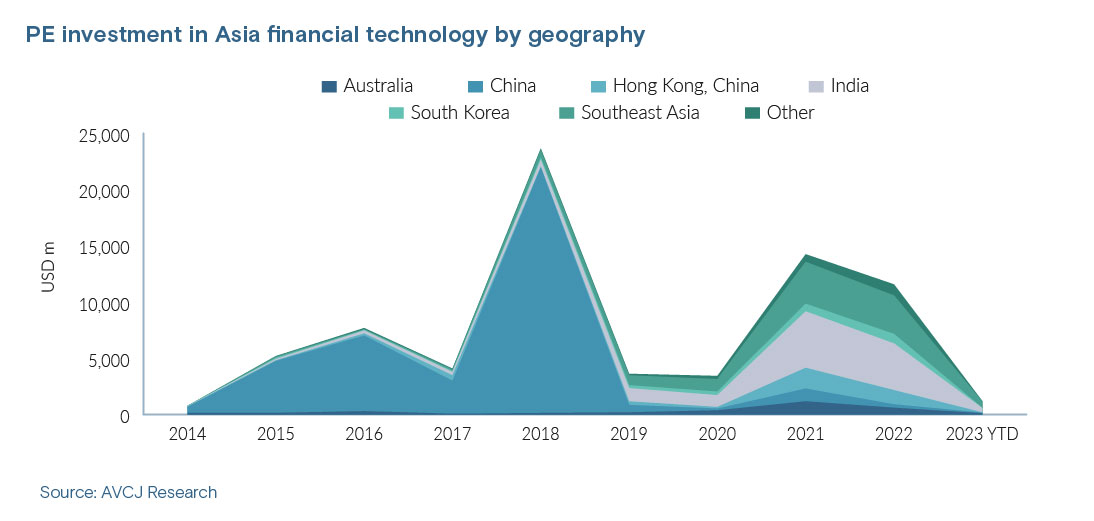

ASIA FINTECH REORIENTATION

Investment in China financial technology peaked in 2018 with bumper rounds of units of Alibaba Group, JD.com, and Baidu, then collapsed a year later amid a clampdown on peer-to-peer lending. Ant Group's aborted IPO a year later ruled out a rebound.

Between 2014 and 2018, China absorbed 88% of all PE capital entering Asia fintech. For 2019 to date, its share is 7%. In China's absence, other markets have come to the fore – notably India, Southeast Asia, and to a lesser extent Hong Kong and Australia. India and Southeast Asia accounted for two-thirds of the USD 3.4bn put to work in 2020. This share remained reasonably consistent in 2021 and 2021 but the pie was much larger – USD 14.2bn and USD 11.6bn. This dominance was underlined in the past week through significant investments in the likes of Singapore's insurance technology specialist Bolttech and Indian payments platform PhonePe. Both have experienced rapid rises to prominence: Bolttech's recent USD 196m round took its overall funding to more than USD 450m in the past two years; PhonePe's USD 100m raise took its ongoing round to USD 850m against a target of USD 1bn. Both are well-established unicorns with valuations of USD 1.6bn and USD 12bn, respectively. Another common characteristic – shared with more than a few other large Asian fintech players – is the guiding presence of a parent entity. Bolttech is a subsidiary of Hong Kong's Pacific Century Group; PhonePe only recently fully separated from Flipkart and the e-commerce marketplace remains a significant shareholder.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.