Weekly digest - May 10 2023

|

By the Numbers

AVCJ RESEARCH

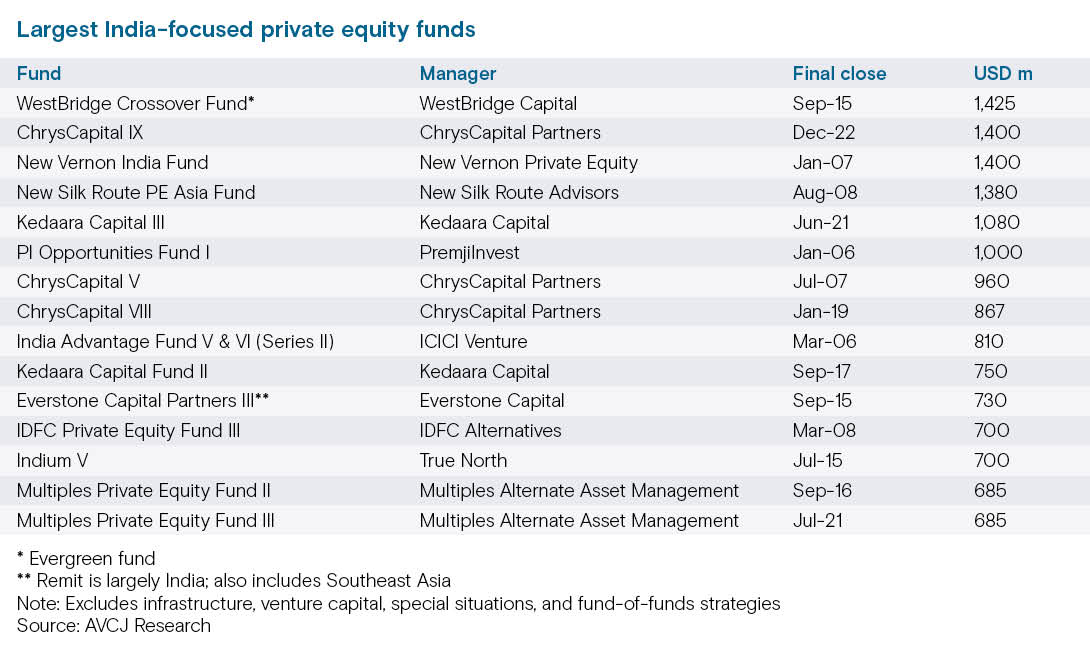

INDIAN MANAGERS SCALE UP

Multiples Alternate Asset Management is more than halfway on its journey to join the small subset of India-focused private equity players with a USD 1bn-plus fund to their name. The GP recently announced a USD 640m first close on its fourth vehicle, which is supported by the likes of Canada Pension Plan Investment Board (CPPIB), the International Finance Corporation (IFC), and State Bank of India (SBI).

AVCJ Research has records of only six India private equity funds of USD 1bn or more – and one of those is an evergreen vehicle while another is a captive investment unit. Two special situations funds (soon to be three, given Kotak Private Equity hit a first close of USD 1.25bn on its latest vehicle), two fund-of-funds, and one venture capital fund have also crossed the USD 1bn threshold. The number is significant not only in terms of its size but also as a bellwether for Indian private equity and a historical marker of how the industry has progressed. Kedaara Capital made an initial breakthrough in 2021, closing its third fund on USD 1.1bn, up from USD 750m in the previous vintage. ChrysCapital Partners followed suit last year, scaling up from USD 867m to USD 1.4bn. However, it is worth noting that six of the 12 largest Indian PE funds to date were raised before the global financial crisis. Indeed, ChrysCapital secured USD 1.25bn for its fifth fund in 2007 but the corpus was later pared back to USD 960m as investment conditions deteriorated. Indian private equity then spent several years in the wilderness before returning to mainstream favour relatively recently. The GPs behind two of the top 12 funds, each of which raised over USD 1bn, are now essentially defunct: New Silk Route Advisors and New Vernon Private Equity. Several others have – or may well – raise less in their latest vintages than they did before.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.