Weekly digest - April 26 2023

|

By the Numbers

AVCJ RESEARCH

A GAP IN THE MARKET?

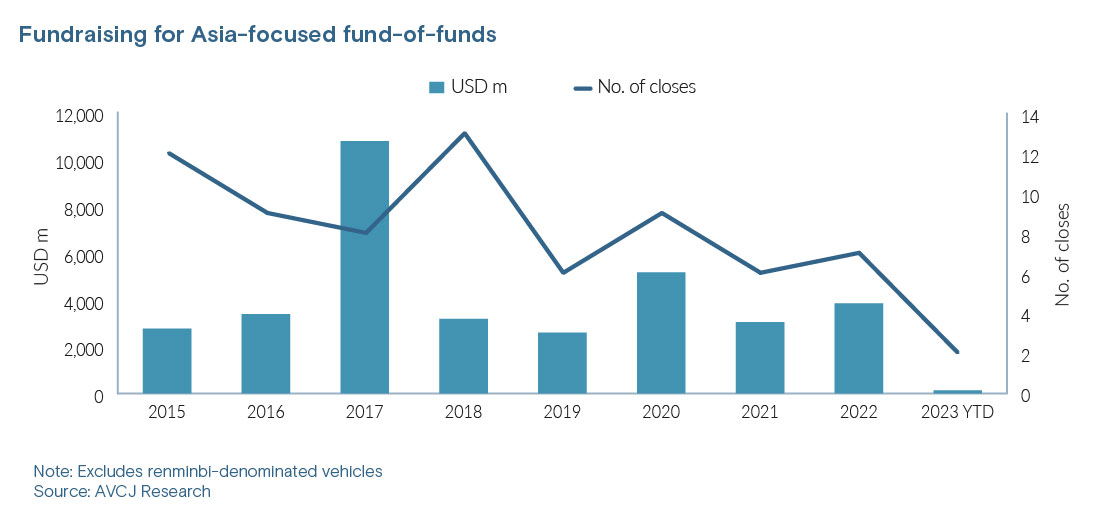

Singapore-based Collyer Capital appears to be breaking new ground with the launch of its Southeast Asia-focused fund-of-funds. AVCJ Research has records of around 60 partial or final closes by fund-of-funds in Asia over the past seven years, excluding renminbi-denominated vehicles. None are solely targeting Southeast Asia.

Collyer aspires to raise just USD 100m for its first vintage – a relatively small total in an industry that, if anything, has become more concentrated. Nearly USD 35bn has been committed to fund-of-funds in Asia since 2015. The annual average of USD 4.3bn is skewed upwards somewhat by a Korean government-backed industry restructuring vehicle that closed on USD 6.1bn in 2017. It is one of only 14 USD 1bn fund-of-funds that together account for more than two-thirds of all capital raised. Asia Alternatives, Axiom Asia and Temasek Holdings-owned Azalea Asset Management are responsible for three apiece. The most recent final closes were by Asia Alternatives and LGT Capital Partners, which raised USD 2bn and USD 1.65bn, respectively, in 2022. The number of funds achieving closes has also dropped off in recent years: there were 28 between 2019 and 2022 compared to 42 in 2015-2018 and 48 in 2011-2014. It reflects a general shift in investment demand – characterised by a shift from co-mingled fund-of-funds to more customised mandates – but Collyer believes the traditional approach is warranted in Southeast Asia. "The product is designed for investors that may not be willing to base themselves here but are curious about Southeast Asia and don't necessarily want a pan-Asia fund-of-funds. It could be argued that diversification through a fund-of-funds is less justified in developed Asia and more justified in Southeast Asia, where it can solve issues like geographic risk and foreign exchange," said Eric Marchand, one of the founders.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.