Weekly digest - April 05 2023

|

The AVCJ Weekly Digest will skip an issue next week. It returns on April 19.

|

|

By the Numbers

AVCJ RESEARCH

CHINA BLUES

"If you've a venture capital manager in China and you're not Sequoia, Qiming, or Matrix, your hit rate is going to be one in 1,000 right now. It's almost not worth it," said one placement agent in a sobering assessment of the fundraising environment.

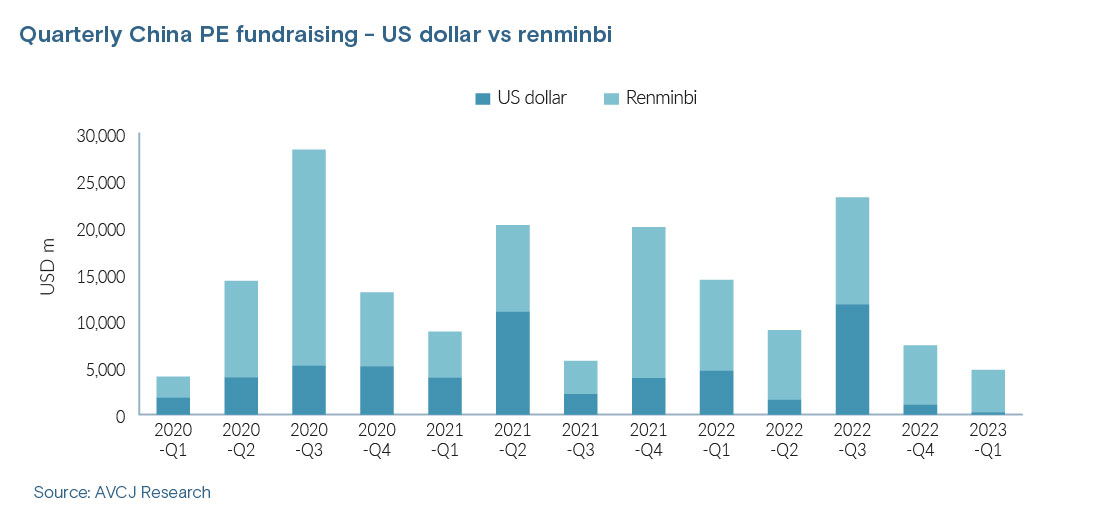

A lot of China GPs are said to be reviewing their fundraising targets. They include Hopu Magnolia, a growth capital unit of Hopu Investment Management, which has scaled back its ambitions from USD 450m to USD 250m. Hopu Magnolia has also asked LPs for an extension to its fundraising period. A relatively strong start, featuring support from US and Japanese LPs, couldn't be sustained in the face of COVID-19 and geopolitical tensions, the agent added. Other sources identified several managers that achieved first closes but have since run aground, raising hardly anything in the past 12 months. They continue to doggedly pursue original or revised targets while LPs are asking whether it wouldn't be better to take what's there, focus on deployment, and return to market when conditions improve. Provisional data from AVCJ Research for the first quarter of 2023 indicate that China managers raised a paltry USD 4.7bn, with more than 90% of that going to renminbi-denominated funds. But the renminbi total is still the lowest since the first quarter of 2020 when investors will dealing with the immediate impact of COVID-19. The US dollar total has never been lower – although commitments have been on a downward trend for the past four quarters. Bumper fundraises by Sequoia Capital China and Qiming Venture Partners turned the third quarter of 2022 into an outlier.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.