Weekly digest - March 29 2023

|

By the Numbers

AVCJ RESEARCH

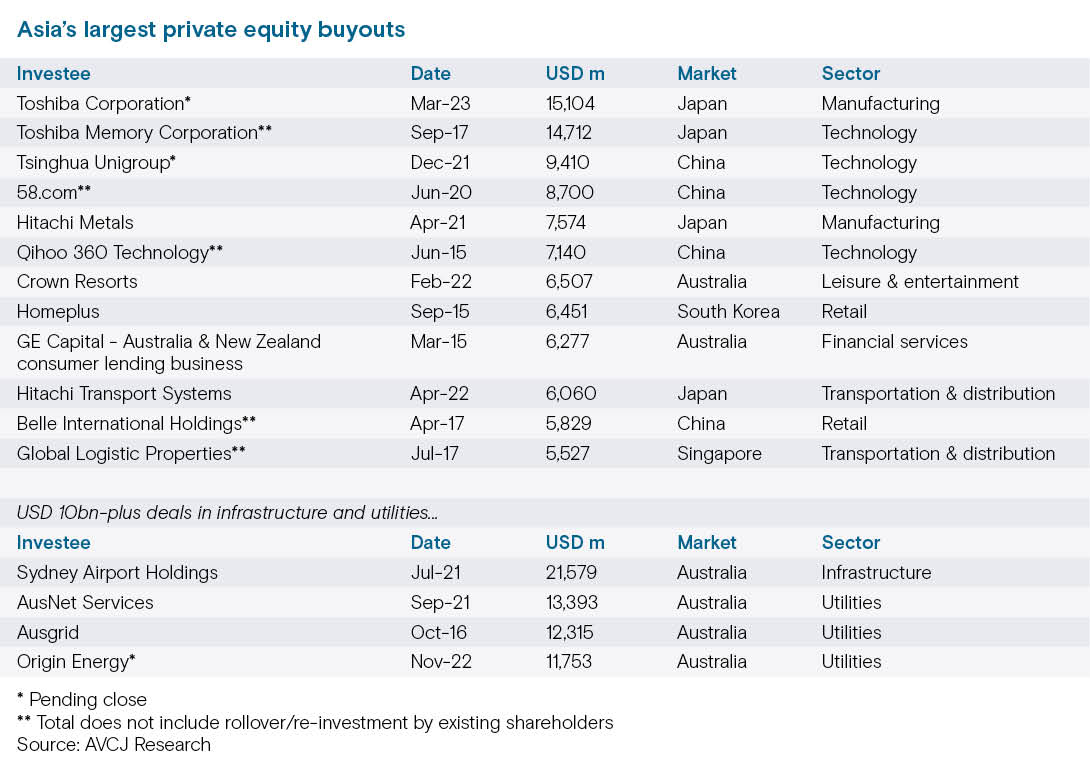

A TOUCH OF TOSHIBA

Toshiba Corporation, as a consequence of its strategic missteps and questionable governance, is responsible for Asia's two largest PE buyouts. Assuming the Japan Industrial Partners-led tender offer for Toshiba proceeds, it will sit alongside Toshiba Memory Corporation – a Bain Capital led carve-out in 2018 – at the top of the list.

Both deals are worth JPY 2trn (USD 15.1bn), but the yen has depreciated in value since 2018, so Toshiba will occupy second place. Some of the deals listed below, including Toshiba Memory – are sized smaller than their enterprise value because AVCJ Research subtracts any rollover equity. Hence Toshiba is at the summit. Each of the top 12 was announced less than six years ago. However, only four were announced in 2020 or later, which means most predate the acme of Asia's private equity boom. There of the region's four USD 10bn-plus infrastructure and utilities deals – listed separately – were transacted during this period. Australia is inevitably the dominant geography in that space. For private equity, Japan is well-represented, given the rise of carve-outs as an investment theme. Privatisations of US-listed Chinese companies – executed with a view to re-listing in Hong Kong or Shanghai – also feature, but alongside more idiosyncratic China plays like the Tsinghua Unigroup semiconductor restructuring and Belle International's succession-driven Hong Kong privatisation. It seems unlikely there will be further additions to this list in the coming months as economic uncertainty, higher financing costs, and expectations of a deeper correction in valuations are preventing deal groundwork from turning into deal announcements. A total of USD 36.3bn has been deployed in the first quarter of 2023 – down from USD 53.9bn in the final three months of 2022 – and Toshiba accounts for nearly half of that. It is one of only eight investments of USD 500m or more. contribute to the stream of liquidity emanating from one of Asia's more reliable markets.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.