Weekly digest - March 22 2023

|

By the Numbers

AVCJ RESEARCH

JAPAN'S LIQUIDITY STREAM

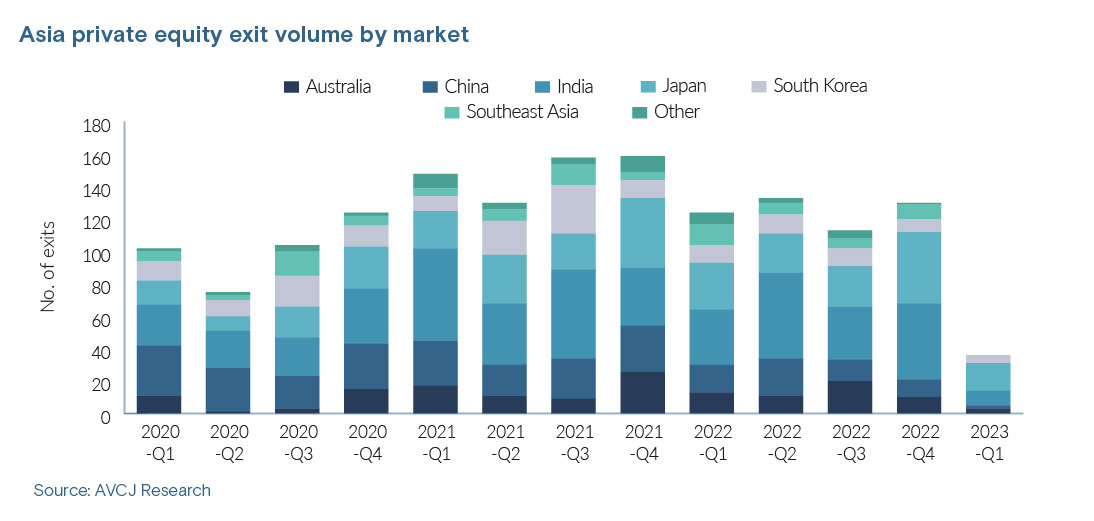

When examining Asia PE exits by market, following the money can be frustrating. Region-wide, the picture is reasonably clear: deal-making slumped when COVID-19 hit, rebounded in the second half of 2021, then lingered around pre-pandemic levels before weakening in the second half of 2022. Market-by-market, the picture is cloudy.

Australia is responsible for much of the exit deal value in the past two years, yet during this period its quarterly totals have ranged from USD 1.7bn to USD 15.8bn, according to AVCJ Research. Similar peaks and troughs are visible in other jurisdictions. Exits for the first quarter of 2023 to date have been abysmal, apart from in Korea where one transaction makes up 75% of the regional total. In terms of exits by volume – where a minority exit from a tiny start-up counts for the same as a blockbuster trade sale – there is a bit more consistency. The China contribution has fallen; the India contribution has risen; Korea and Southeast Asia are, admittedly, all over the place; and Japan appears to be a true outperformer. The number of exits region-wide neared 160 in each of the third quarter and fourth quarter of 2021. It then moderated to a quarterly average of 125 in 2022 and fell off a cliff in early 2023. Japan closed out last year with 44 exits in the final three months, more than it achieved during the same period in 2021. Fewer than 40 deals have been announced this year, but Japan still accounts for 17 of them. Many of these transactions are small and valuations often don't get disclosed. Aspirant Group recently announced its third exit in three weeks – selling offshore drilling business Japan Drilling to a local strategic – but none of the three came with deal values. Regardless of size, they still contribute to the stream of liquidity emanating from one of Asia's more reliable markets.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.