Weekly digest - March 15 2023

|

By the Numbers

AVCJ RESEARCH

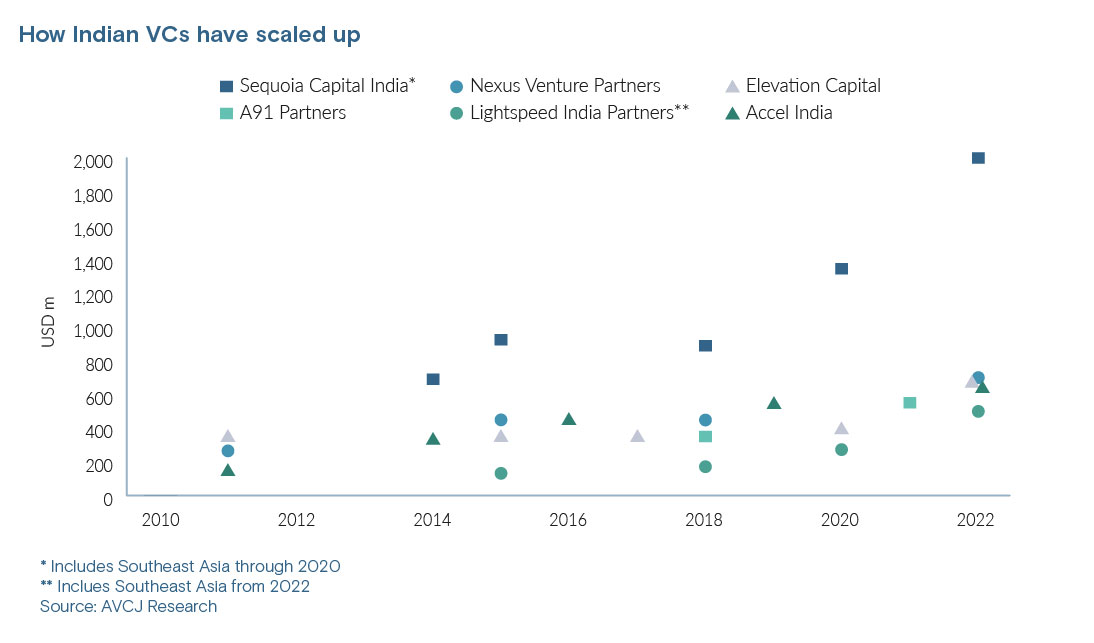

INDIA'S VC SCALE-UP

Nexus Venture Partners recently announced a final close of USD 700m on its latest India fund, up from USD 450m in the previous vintage. It is significant in part because Nexus was previously highly disciplined on fund size. Elevation Capital was much the same, remaining in USD 350m-USD 400m territory for more than a decade. Last year, though, the firm closed its latest fund on USD 670m.

The ramp up in size is evident among many of the best-known India VC firms. Sequoia Capital India raised USD 2bn for its latest vintage in 2022 compared to USD 1.35bn last time it came to market – and that is despite the Southeast Asia allocation spinning off into a fund of its own. Lightspeed India Partners raised USD 500m last year, up from USD 275m and USD 175m in the two prior vintages. Accel Partners has been relatively more restrained: its last three funds have come in at USD 450m, USD 550, and USD 650m, with the most recent of also closing last year. The fund size phenomenon tracks a surge in technology sector investment in India. In 2021, USD 11.7bn went into early-stage deals and USD 23.8bn went into growth-stage rounds. This compares to USD 4.6bn and USD 5.2bn in 2020. There was a retreat in 2022 – to USD 8.3bn and USD 10.5bn – amid challenges for the tech sector globally – but many GPs claim the market has reached an inflection point. Nexus said that "there has been no better time for technology innovation," pointing to a pandemic-driven acceleration in digital adoption, start-ups tapping top talent with the onset of remote working, and breakthroughs in areas like artificial intelligence (AI).

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.