Weekly digest - March 01 2023

|

By the Numbers

AVCJ RESEARCH

THE RENMINBI QUESTION

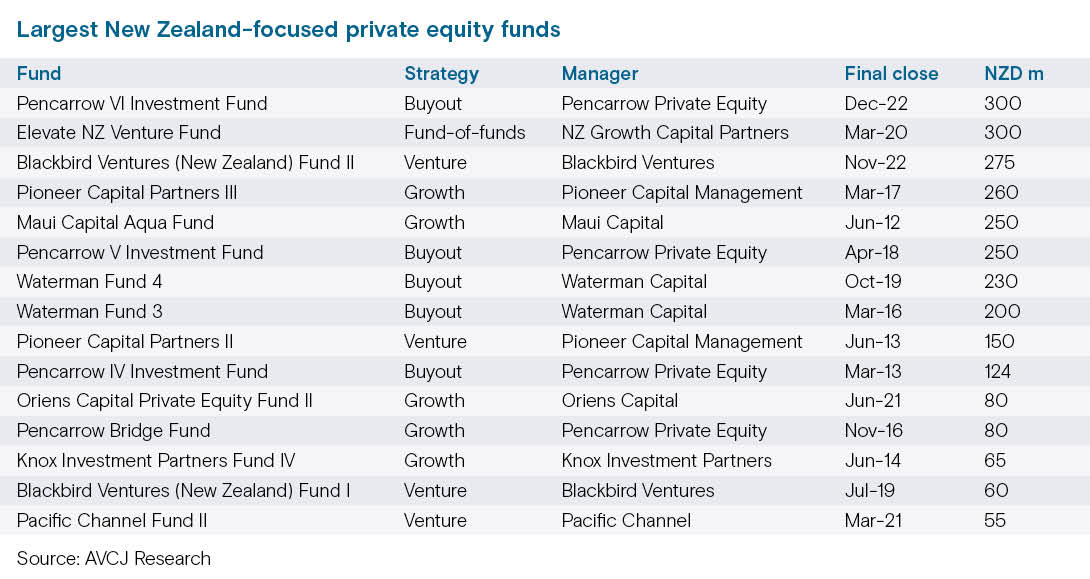

New Zealand-based Pencarrow Private Equity has closed its sixth fund at the hard cap of NZD 300m (USD 187m), having scaled up from NZD 250m in the previous vintage. The LP base is similar to Fund V, featuring a US family office and a collection of local foundations, community trusts, and indigenous Maori financiers known as iwi groups.

The new fund is the joint largest raised for deployment in New Zealand alongside a fund-of-funds managed by NZ Growth Capital Partners. A vehicle raised by Australia-based Blackbird Ventures, which closed on NZD 275m last November, is in third. The ranking of the top 15 New Zealand vehicles raised to date reflects the relatively concentrated pool of domestic managers: the likes of Pencarrow, Pioneer Capital, and Waterman Capital appear multiple times. One characteristic these GPs share is a propensity for cross-border expansion – recognition that the New Zealand market alone cannot offer the scale most need for critical mass. PE investment in the country reached a record USD 5bn in 2022 – in contrast to most other Asian markets, which peaked in 2021. An intermittent stream of large-cap deals skews the headline numbers, most recently a string of telecom tower deals.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.