Weekly digest - February 22 2023

|

By the Numbers

AVCJ RESEARCH

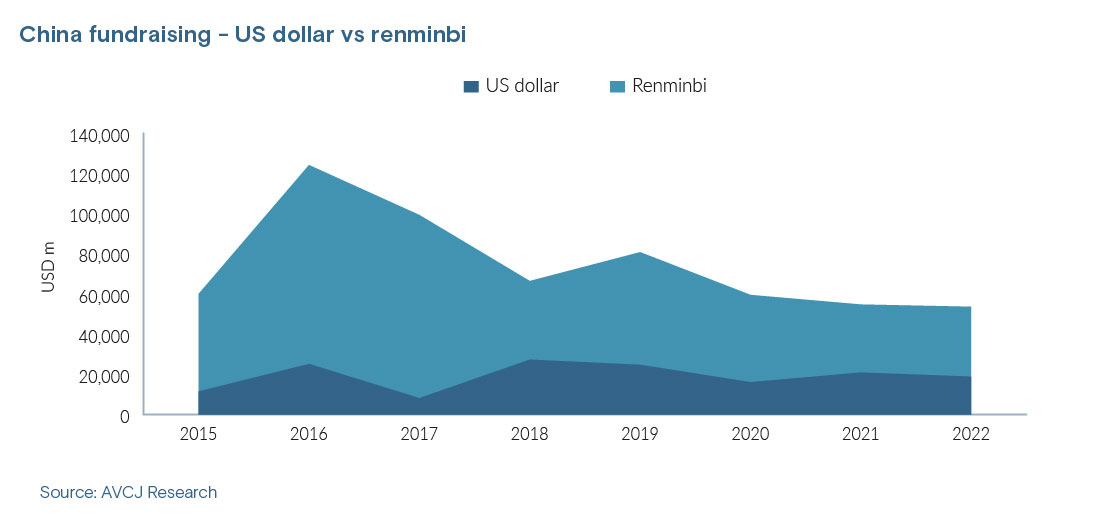

THE RENMINBI QUESTION

DCM raised renminbi-denominated funds at the behest of its target entrepreneurs. Complaining that changing US dollars into local currency was too difficult, they petitioned the venture capital firm to give them local currency instead. DCM acquiesced but the initiative lost traction when China relaxed its conversion policies.

Capital raised for renminbi funds reached USD 34.8bn in 2022, up slightly on 2021, but still a pale imitation of the environment a few years ago. Yet the lack of a resurgence in fundraising activity appears to run contrary to China's prevailing dynamics. Start-ups in sensitive industries like semiconductors and deep technology are said to be wary of taking US dollars in case they find themselves caught in a bind later if – for example – overseas investors are forced to exit their positions. Why aren't more renminbi funds being raised in response? Maybe they will, maybe they won't. Separately, it might be that GPs with US dollar funds are wary of the renminbi space – high-quality LPs are relatively few – and they recognise it is not a prerequisite. First, foreign and local investors can co-exist in companies that adopt joint venture structures. Second, there is the Qualified Foreign Limited Partnership (QFLP) regime. Last week, Primavera Capital Group secured a QFLP quota for its debut VC fund. Some of the capital can be converted into renminbi at the fund level and invested locally. Going onshore doesn't make sensitive sectors more accessible – regulators focus on the ultimate beneficial owners – but it does make life easier in other respects.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.