Weekly digest - February 15 2023

|

By the Numbers

AVCJ RESEARCH

SCALING UP IN SOUTHEAST ASIA

Asian Infrastructure Investment Bank (AIIB) is making its first foray into venture capital through a USD 160m programme aimed at small-scale funds targeting cleantech and technology-enabled sustainable infrastructure. The capital – a core pool of USD 130m plus USD 30m for co-investment – will be deployed over the course of three years.

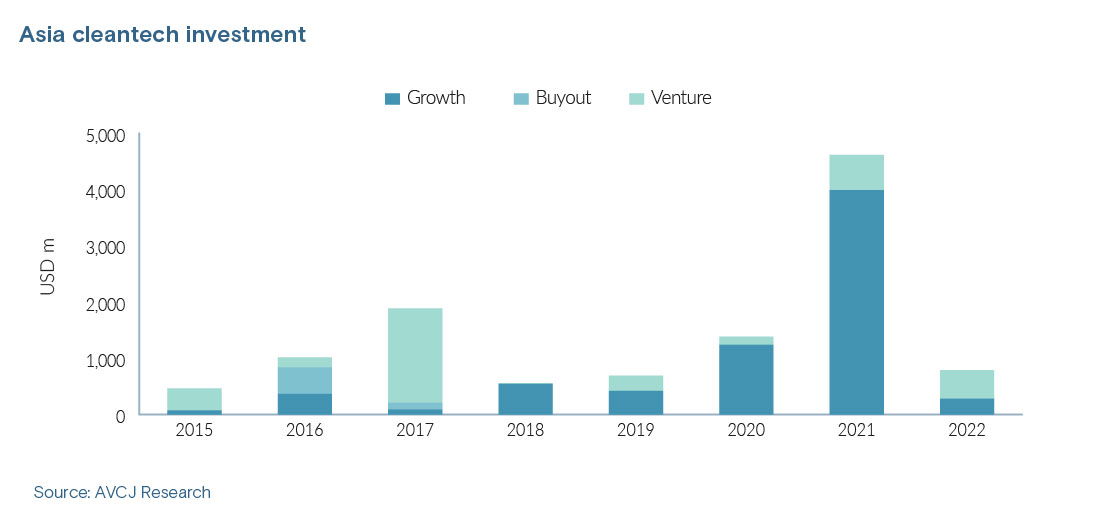

It is not Asia-only. AIIB flagged opportunities in South and Southeast Asia and across the Caucasus, Central Asia, Africa, and the Middle East, noting that VC investment in these geographies continues to thrive. At the same time, "these regions are facing less representation, which invites further capital to bridge the funding gap." PE and VC investment in Asia cleantech has been on an upward trend in recent years, rising from USD 691m to USD 1.38bn, and then a record USD 4.62bn in 2019, 2020, and 2021. There was an inevitable retrenchment to USD 791m in 2022. Activity is heavily weighted towards China and the electric vehicle supply chain (though the annual totals exclude investment in electric vehicle manufacturers, which is even more skewed towards China). However, similar themes are beginning to play out in markets like India, which would boost the Asia ex-China showing. It remains to be seen how broadly AIIB defines cleantech and what criteria is put in place for manager selection. Specialist early-stage cleantech GPs are scarce in Asia and those with meaningful track records are even scarcer. However, there is increasing generalist activity in the space – and some managers may even rebrand themselves as cleantech for the sake of a commitment.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.