Weekly digest - February 01 2022

|

By the Numbers

AVCJ RESEARCH

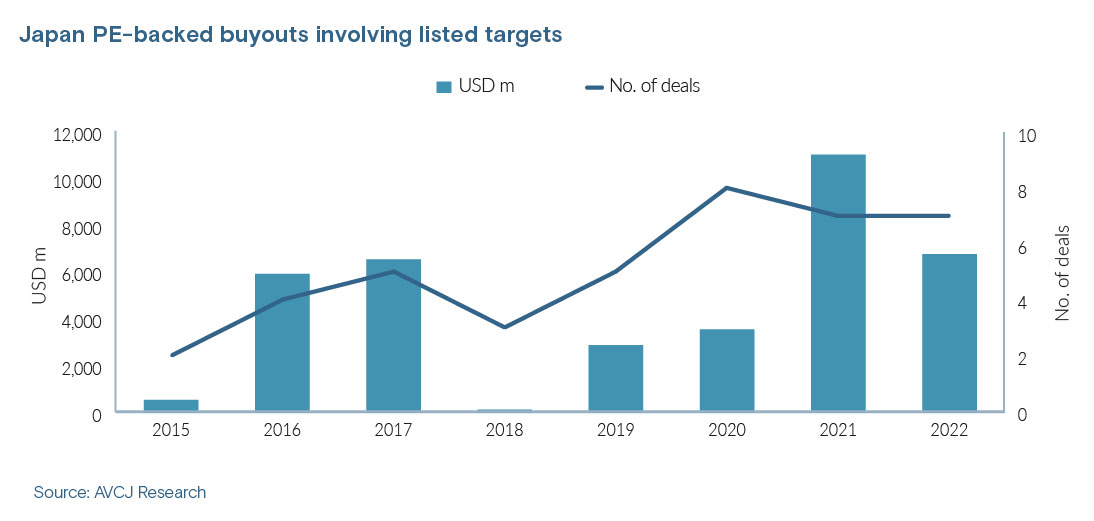

LOVE ME TENDER

Bain Capital has plenty of experience taking control of listed Japanese companies, participating in at least 10 such deals – chiefly via tender offers – over the past decade. The firm laid down a marker for 2023 by winning board endorsement for a buyout of marketing services business Impact HD. It also exited online advertising player Net Marketing via a trade sale barely four months after completing a tender offer.

Prior to 2016, private equity seldom featured in such transactions in Japan. However, more than 20 have been announced since 2020 with aggregate value exceeding USD 21bn, according to AVCJ Research. They are increasingly a feature of corporate carve-outs, whereby the PE investor agrees to buy the parent company's stake in a listed subsidiary and then launches a tender offer to take out other shareholders – the 2021 total topped USD 10bn largely because Bain took this approach with Hitachi Metals. Some situations arise specifically because companies are listed – such as deals arising from activist investor pressure – but ultimately tender offers are a mechanism. The Impact HD opportunity emerged because the majority shareholder realised that external capital and expertise were required to drive growth and sought a PE partner.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.