Weekly digest - December 07 2022

|

By the Numbers

AVCJ RESEARCH

RELATIVE FINTECH RESILIENCE

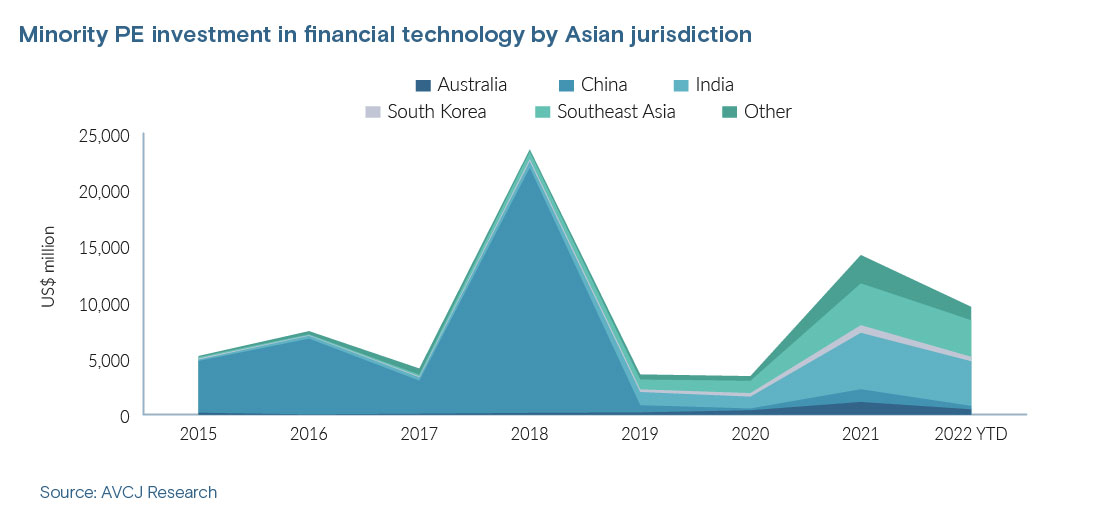

The recent history of early and growth-stage investment in Asian financial technology assets is shaped by China. Until 2019, China absorbed 90% of all capital entering the space over a four-year period, culminating with Ant Group's USD 14bn Series C in 2018. The comedown was rapid, instigated first by an intensification of a crackdown on P2P lending and then by Ant Group's failed IPO and further regulatory reforms.

For 2019 onwards, the China share of fintech investment is 7%, compared to 36% for India and 29% for Southeast Asia. India has benefited from India Stack , an ambitious government project that has created an open access fintech infrastructure spanning biometric identification, data security, and a unified payments interface. In Southeast Asia, meanwhile, fintech has developed lock-step with deepening smart phone penetration, aided by demand from a sizeable unbanked population. Exclude Ant Group's Series C and deployment in the space Asia-wide reached a record USD 14.2bn in 2021. This pace hasn't been maintained in 2022, with USD 9.6bn deployed to date. Yet the 33% decline compares to a 45% drop-off for early and growth-stage investment across all sectors. It is a similar story for India and Southeast Asia, which together account for three-quarters of overall fintech investment in 2022. Evidence of continued investor appetite came this week when KreditBee , an Indian lending start-up, raised USD 80m in Series D funding from Premji Invest, NewQuest Capital Partners, Mirae Asset Ventures, MUFG Bank, and Motilal Oswal Alternates. The company – a subsidiary of Finnov, which also controls non-bank financing company Krazybee – is expected to close the round on up to USD 150m.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.