Weekly digest - November 30 2022

|

By the Numbers

AVCJ RESEARCH

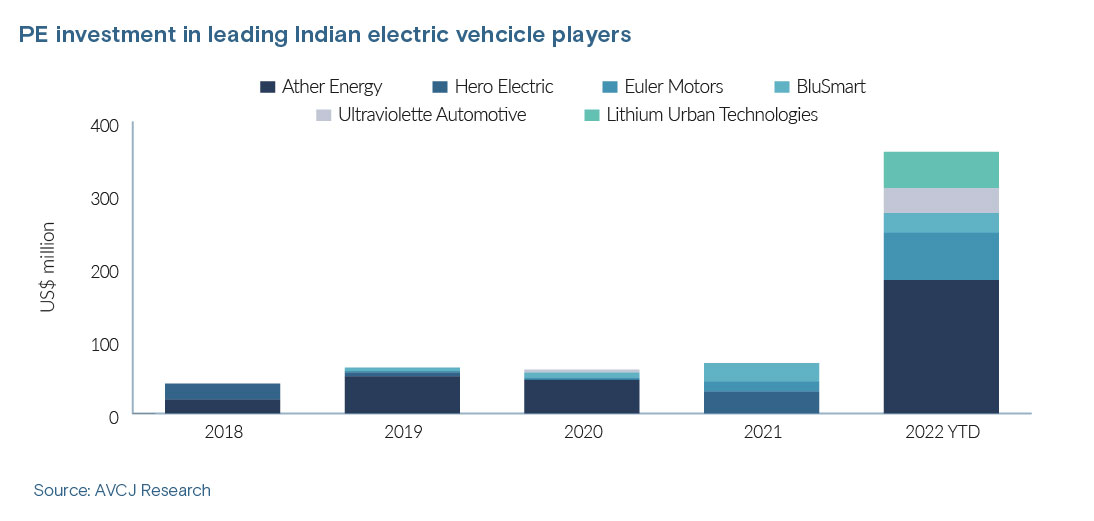

GOING ELECTRIC

More than USD 1.6bn has been put to work in India's electric vehicle (EV) space since 2018. It represents a fraction of the China total, but momentum is building, with a dozen investments announced since the start of the year, according to AVCJ Research. It is the first time that deal count has entered double figures on an annual basis.

Inevitably for a nascent industry, capital is concentrated on a handful of companies. TPG Rise Climate and ADQ's USD 994m commitment to the EV unit of Tata Motors last October is the ultimate outlier. Dismiss this from consideration and six companies come to the fore: Ather Energy, Hero Elecrtric, Euler Motors, BluSmart, Ultraviolette Automotive, and Lithium Urban Technologies. They pursue different business models – two-wheeler vs four-wheeler, manufacturer vs fleet operator – but they are the independent vanguard. Together, the six start-ups have raised nearly USD 600m, with more than half of that sum secured in 2022. Last week, Ultraviolette added USD 24m to an ongoing Series D that now amounts to USD 34m. It follows BluSmart doubling the size of its Series A to USD 50m, Euler securing a USD 60m Series C, Ather raising USD 178m across a two-tranche Series E, and EverSource Capital acquiring a majority stake in Lithium Urban for USD 50m. Asked about the timing of this surge, Arpit Agarwal, a director at Blume Ventures, told AVCJ that until recently EVs simply were not good enough. The first generation was of Chinese design and based on Chinese, and therefore unsuited to India's roads. It is only now that vehicles built and made for India by India are becoming widely available. EV sales reached 520,000 units in the 12 months ended March 2022, a more than twofold increase on the previous year, according to Avendus Capital. Two-wheelers dominate the market, accounting for 322,000 in sales. In the three-wheeler cargo EV segment, sales increased from 800 to 6,400 units. Nevertheless, penetration remains relatively low.h public market selloffs in the sector globally.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.