Weekly digest - November 23 2022

|

TALKING POINTS

AVCJ AWARDS - AND THE WINNERS ARE...

Advantage Partners, Affinity Equity Partners, Baring Private Equity Asia, The Blackstone Group, CDH Investments, Five V Capital, Future Capital, L Catterton, Nexus Point Capital, Pacific Equity Partners, Potentia Capital, Quadrant Private Equity, Qiming Venture Partners. See here for more information.

|

|

By the Numbers

AVCJ RESEARCH

APPETITE FOR DEPLOYMENT

"Two years ago, part of your life was going after the hottest company in the most aggressive way begging the entrepreneurs for a piece of the allocation," Tony Jiang, co-founder and a partner at Ocean Link, told the AVCJ Private Equity & Venture Forum.

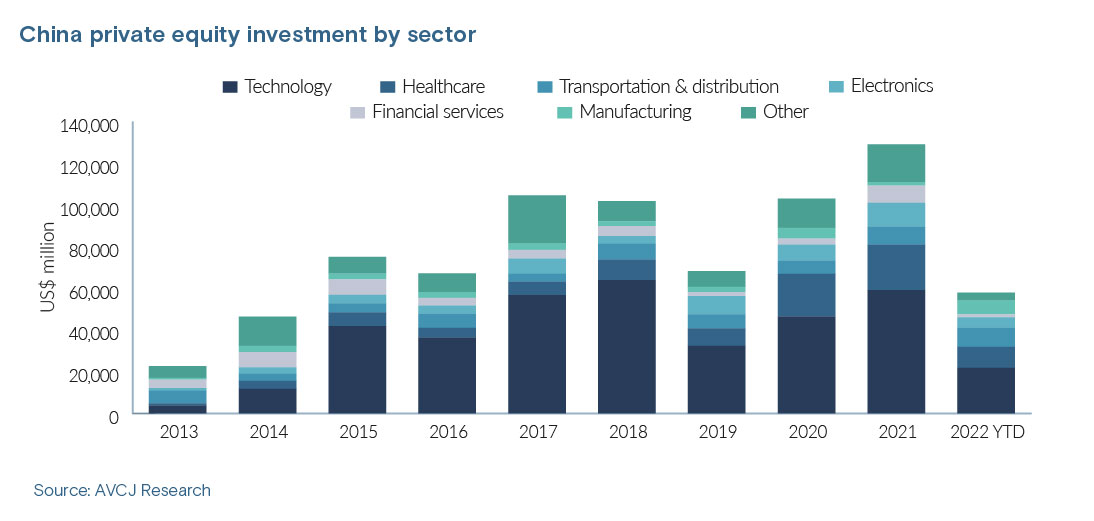

"There was very little room to negotiate on valuations and very little respect for investors. Fundraising was relatively easy, but then doing deals was actually very difficult and to some extent pretty scary. Today, I think it's almost the opposite." Other investors chimed in with observations that valuations do not reflect the longer-term fundamentals of China's economy on an absolute or relative basis compared to other economies. Put simply, they are keen to deploy capital because the drop in valuations has made China attractive, despite economic challenges, regulatory uncertainty, and the government's apparent resolve to pursue zero-COVID policies. Nearly USD 58bn has been invested in China year-to-date, down from USD 129.2bn in 2021 and USD 103.2bn in 2020. The average for the prior eight years is USD 87bn. Technology is the biggest loser, having received USD 21.9bn so far this year, compared to USD 59.3bn in 2021. It is the least since 2014. Healthcare is also down by more than half, which is consistent with public market selloffs in the sector globally. Capital appears to be gravitating towards tangible assets. Over USD 9.3bn has been pumped into transportation and distribution in 2022, putting it within touching distance of healthcare as the second-largest sector. The 2021 total was USD 8.6bn. Meanwhile, manufacturing has stolen third place, having risen from USD 1.7bn to USD 6.6bn.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.