Weekly digest - November 09 2022

|

By the Numbers

AVCJ RESEARCH

CHALLENGED CHINA

Looking for a watershed moment that crystallised the China technology opportunity and set the tone for the boom that followed, it is difficult to look past Alibaba Group's IPO in 2014. Even as the company prepared to go public, a new generation of VC firms was emerging, started and staffed by teams coming from large local technology companies.

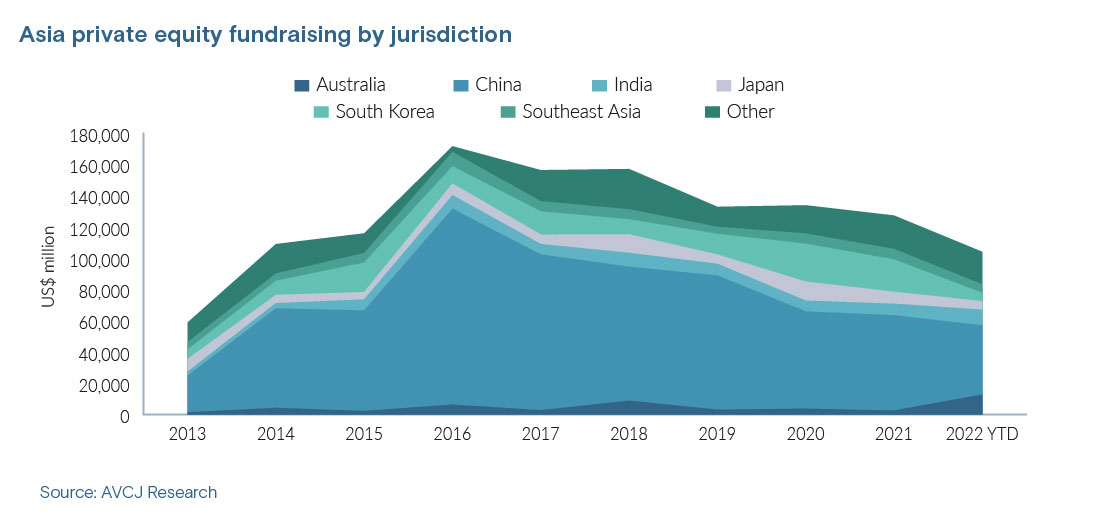

Reflecting this changing dynamic, China PE fundraising – across US dollar and renminbi-denominated vehicles – rose from USD 23.4bn in 2013 to USD 63.7bn the following year. It surpassed USD 100bn for the first time in 2016, nearly did the same again in 2017, and slipped below USD 65bn in 2020. It appears that 2022 will see China fundraising fall short of USD 60bn, with approximately USD 44.3bn raised as of mid-November – and about one quarter of that went to Sequoia Capital China and Qiming Venture Partners. The China share of region-wide fundraising reached 58% in 2014, hit 73% in 2017, and retreated below 50% in 2020. For 2022 to date, it is 42%. This represents at a still significant slice of a smaller pie, with USD 104.1bn raised by Asia-focused managers as of early November, compared to USD 127.4bn for the full 12 months of 2021. The pan-regional fund contribution has held up reasonably well, with the likes of The Blackstone Group and BPEA EQT raising substantially more than in the previous vintage. On a country basis, only two markets of meaningful size have already exceeded their 2021 totals: Australia and India.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

The AVCJ Weekly Digest will skip an issue next week. It returns on November 23.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.