Weekly digest - November 02 2022

|

By the Numbers

AVCJ RESEARCH

SOLID DOWN UNDER

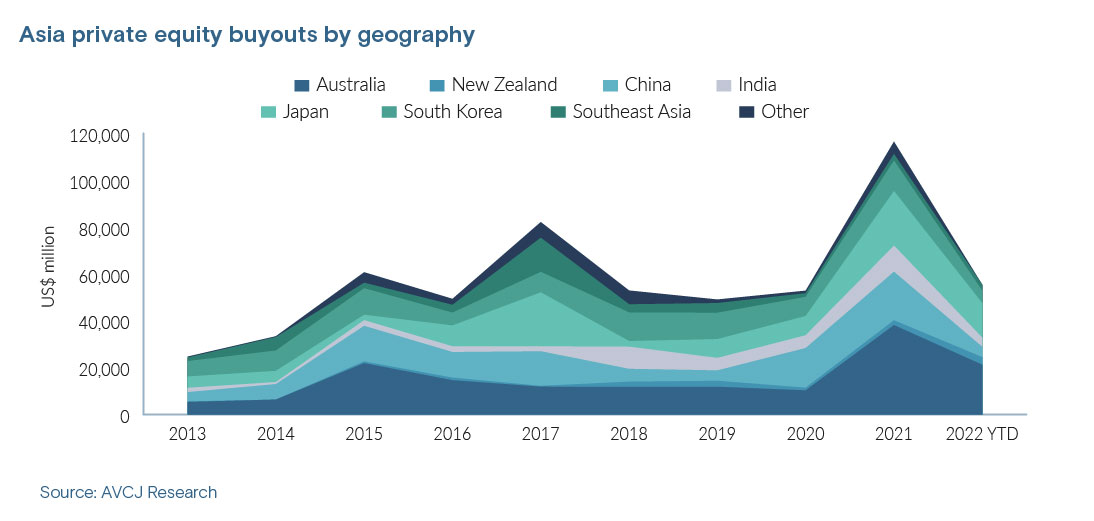

Asia buyout activity has dropped sharply in 2022 as private equity firms struggle with macroeconomic uncertainty, geopolitical concerns, and rising financing costs. Approximately USD 55.3bn has been deployed to date, ahead of the 12-month total for 2020 but well short of the 2021 mark.

Every significant market has retreated, but the impact on Australia and New Zealand has been less pronounced. Together, they were responsible for 34% of regionwide buyouts in 2021, in US dollar terms, a few percentage points above the average for the prior eight years. In 2022, it's 44%. Several more deals have been announced in the last few days, including TPG's AUD 2bn-plus (USD 1.3bn) acquisition of iNova Pharmaceuticals, BGH Capital and Sixth Street Partners' NZD 1.54bn (USD 933m) take-private of donor management business PushPay, and a AUD 483m acquisition of listed enterprise service player Elmo Software at a valuation of AUD 483m. As far as the publicly listed companies are concerned, the GPs might have been tracking them for some time, conducted rudimentary due diligence, and be lying in wait for the stock price to reach an appropriate level. Similarly, this is the third time iNova has ended up with private equity, so the asset is reasonably well known. If familiarity underpins conviction, perhaps stability enables persistence. While securing deal financing in the US remains difficult, private equity have a variety of options in Australia and New Zealand (which are supported by roughly the same lenders). For example, the iNova deal was supported by three global credit investors (HPS Investments Partners, KKR Credit, and Barings Private Credit), one local investor (Metrics Credit Partners), and a couple of Asian banks (HSBC and Nomura), Debtwire, AVCJ's sister publication, reported.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.