Weekly digest - October 26 2022

|

TALKING POINTS

AVCJ AWARDS 2022 - VOTING CLOSES IN FIVE DAYS

Voting for the 2022 AVCJ Private Equity & Venture Capital Awards runs until October 31. To cast your vote, please go to the voting page. Full information on the awards process and the shortlisted nominees is available at the awards website.

|

|

By the Numbers

AVCJ RESEARCH

A LOCAL AFFAIR

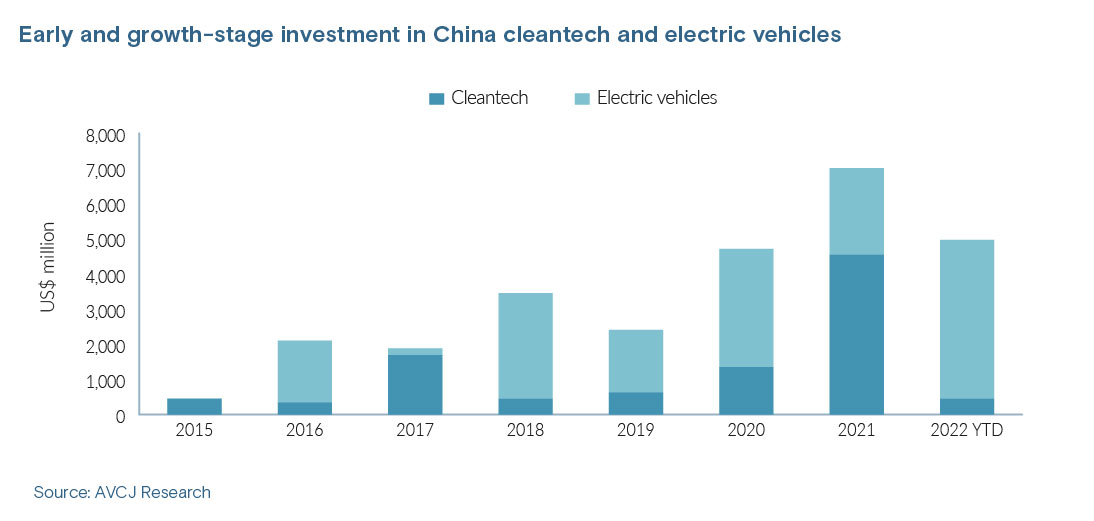

Nio, Xpeng, and Li Auto stole a march on rivals in China's premium electric vehicle (EV) space. Each has gone public, generating liquidity for the PE and VC investors that helped them scale. But the continued surge of capital into EVs suggests the incumbents are not necessarily secure in their positions.

More than USD 4.5bn has been deployed so far this year, surpassing the 12-month high of USD 3.4bn set in 2020. With overall China private equity investment in freefall, cleantech and EV combined – a large portion of the EV value chain, including batteries, falls under cleantech – account for 12% of the growth capital total, up from 7% in 2021. Somewhat inevitably, a single deal has created significant waves. Last week, GAC Aion, an EV brand under state-owned automaker GAC Group raised CNY 18.3bn (USD 2.5bn) in Series A funding at a valuation of CNY 103.2bn. The 53 investors included China Structural Reform Fund, Goldstone Investment, Shenzhen Capital Group, Yingke PE, and assorted government guidance funds. It appears EV has become a game for renminbi-denominated pools of capital – and to some extent, they are helping units of state-owned enterprises play catch up with the rest of the market. Other bumper renminbi rounds this year have been raised by Chongqing Changan New Energy Automobile Technology – a unit of Changan Auto – as well as Hozon Auto, Jidu Auto, and IM Motors.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.