Weekly digest - October 19 2022

|

TALKING POINTS

AVCJ AWARDS 2022 - VOTING IS OPEN

Voting for the 2022 AVCJ Private Equity & Venture Capital Awards runs until October 31. To cast your vote, please go to the voting page. Full information on the awards process and the shortlisted nominees is available at the awards website.

|

|

By the Numbers

AVCJ RESEARCH

INDIA'S VENTURE SURGE

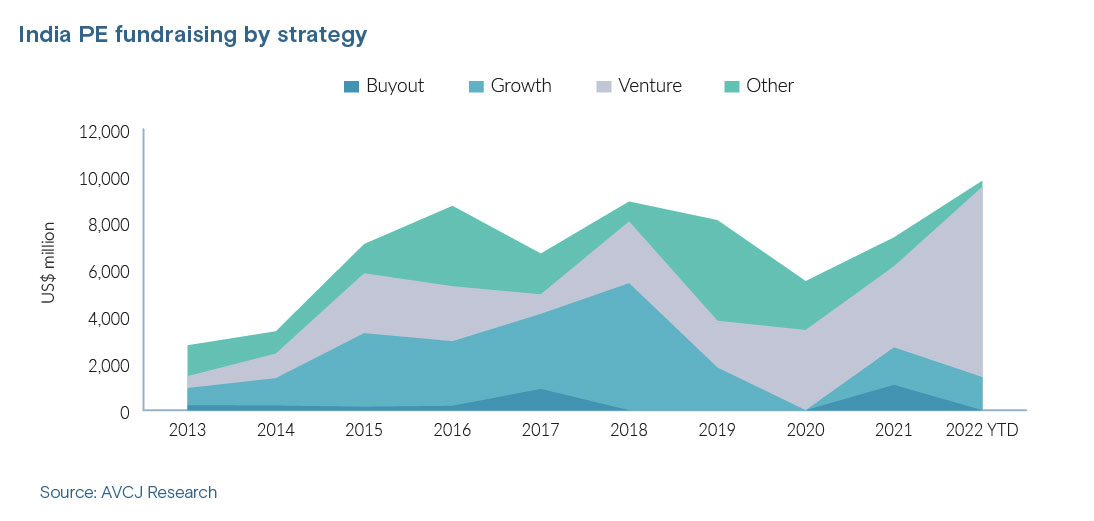

Fireside Ventures is responsible for the third final close this year by a firm established by a senior Helion Venture Partners alumnus, following in the footsteps of Akram Ventures and The Fundamentum Partnership. It also extends a rich vein in India venture capital fundraising activity. Approximately USD 8.1bn has been collected so far this year, compared to USD 3.5bn for the full 12 months of 2021. This has propelled overall India fundraising to a record high of USD 9.9bn, surpassing 2018 when venture capital accounted for just 30% of total capital committed to local managers.

A handful of large-cap funds raised by the likes of Sequoia Capital India, Lightspeed India Partners, and Elevation Capital have made outsize contributions. Still, there is increased activity across the market with new managers and captive units of wealth management firms launching vehicles, often in rupee to tap growing interest from the family office and high net worth segment. A surge in India fundraising was widely expected on the back of the string of breakthrough domestic IPOs by pre-profit internet companies last year, which in turn, sent technology investment to new highs.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.