Weekly digest - October 05 2022

|

By the Numbers

AVCJ RESEARCH

BRAND AWARENESS

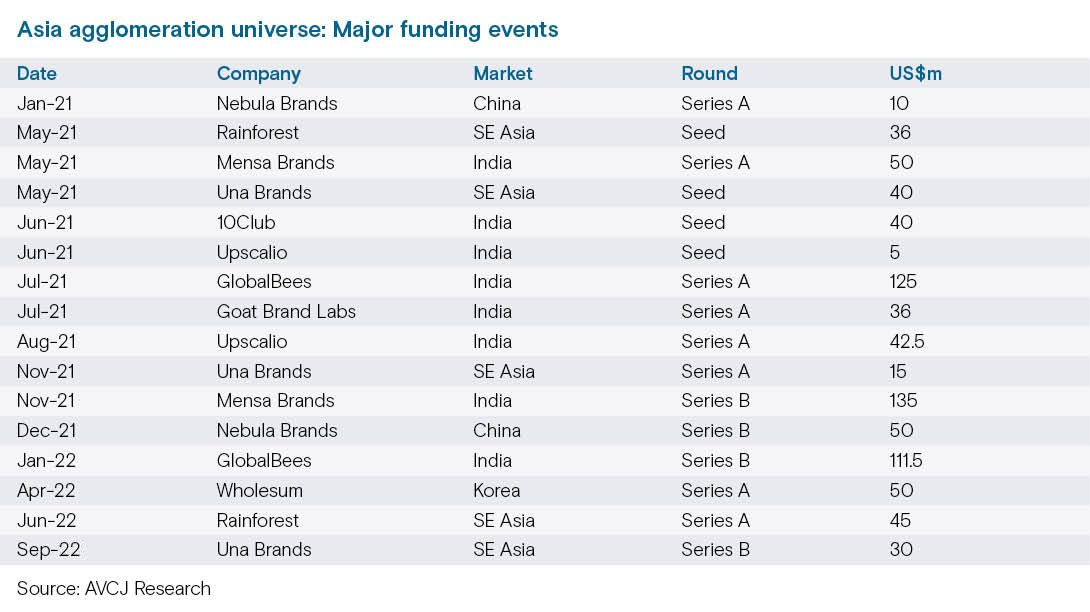

Most of Asia's brand agglomeration platforms are barely 18 months old, yet they continue to attract capital, even though the size and frequency of rounds has slowed. A Series B for Una Brands last week took the number of funding events to 16 since the start of 2021. Total accumulated capital now surpasses USD 800m. Two-thirds of it has gone to India-based start-ups, led by Mensa Brands and GlobalBees, which went from zero to unicorn status within six months and eight months, respectively.

The agglomeration template was established by US-based Thrasio, which buys up small but profitable e-commerce businesses that sell through Amazon's B2B service, Fulfilled By Amazon (FBA). It leverages an understanding of e-commerce marketplace rankings, ratings, and reviews to identify and acquire emerging brands; and then it applies expertise across data science, logistics, and marketing – as well as economies of scale from running a consolidated back-end operation – to accelerate growth. Some Asian platforms are FBA-focused Amazon clones, while others cover multiple marketplaces within a single geography. Una, on the other hand, is pan-Asia and pan-marketplace. "I think everyone will be multi-channel eventually. But what we've seen global platforms do is identify the largest Amazon markets and work their way down the list. Southeast Asia is different because it is dominated by local distribution channels," told AVCJ earlier this year .

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.