Weekly digest - September 28 2022

|

By the Numbers

AVCJ RESEARCH

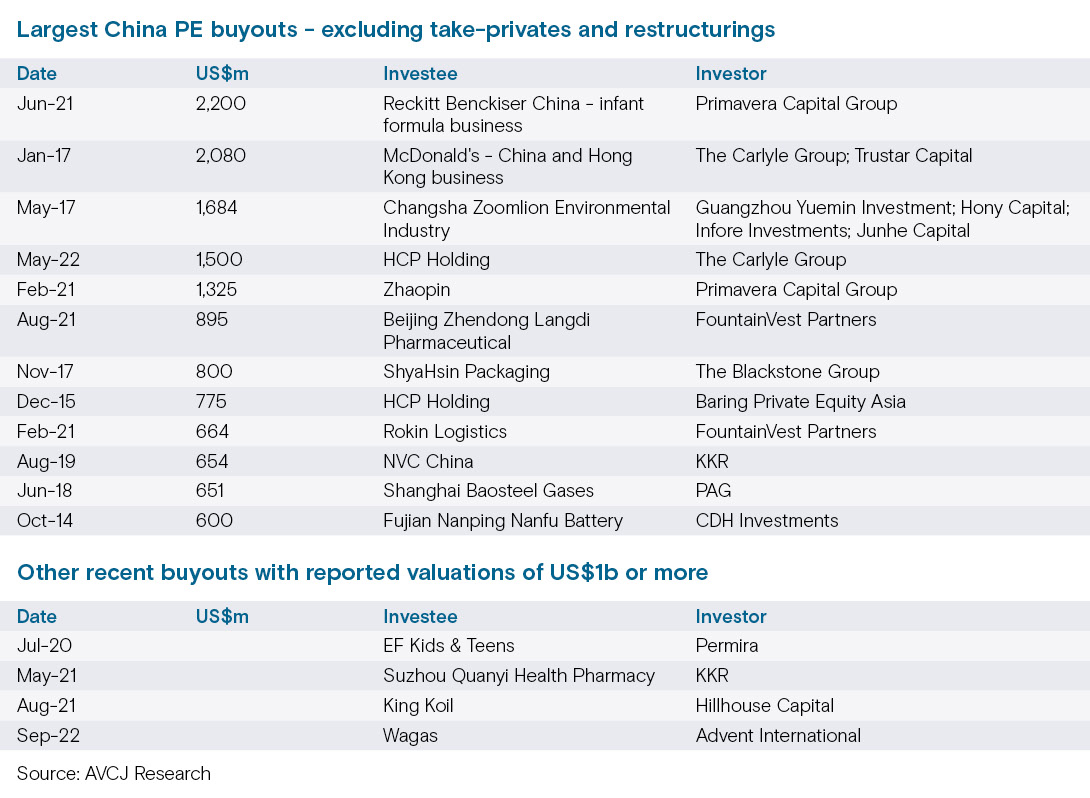

SCARCITY OF CONTROL

Take-privates dominate China buyouts, even though often they don't constitute a change in control - the founder, chairman, and majority shareholder in the target company. These deals account for half of the 10 largest buyouts announced in the country to date, including six of the top eight, according to AVCJ Research.

Advent International's recent acquisition of a majority interest in local Western-style restaurant chain Wagas Group - at a reported valuation of around USD 1bn - is evidence of large-cap opportunities outside of the take-private space. However, they are still relatively limited in number and concentrated around several key themes, such as divestments by foreign corporates (Reckitt Benckiser, McDonald's, Zhaopin, Rokin Logistics, Nanfu Battery, EF Kids & Teens) and sales by founders or families that do not necessarily originate from the mainland (HCP Packaging, ShyaHsin Packaging, Wagas). Moreover, this limited supply is underscored by how assets move from one financial sponsor to another. HCP is under its third successive private equity owner, while one of Advent's earlier big bets - King Koil - was acquired from Trustar Capital and sold to Hillhouse Capital.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.