Weekly digest - September 21 2022

|

TALKING POINTS

AVCJ AWARDS 2022 - NOMINATIONS CLOSE SEPTEMBER 22

Industry participants have until September 22 to put forward firms, fundraises, investments, and exits they believe worthy of consideration. For more information, go to www.avcjforum.com/awards.

|

|

By the Numbers

AVCJ RESEARCH

PEER TO PEER

It was always a matter of when, not if, large institutional investors would pursue PE buyouts in Asia without the aid of third-party managers. Ontario Teachers' Pension Plan (OTPP) has done it twice in the space of four weeks: India-based Sahyadri Hospitals was the pension plan's first sole-control deal; and China-headquartered packaging maker GPA Global has become the first co-control transaction.

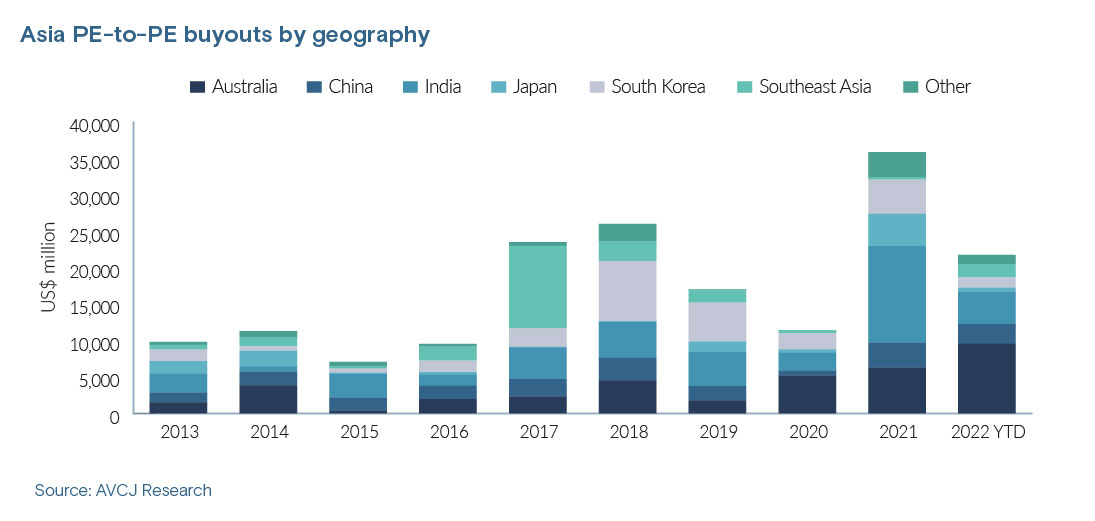

In each case, OTPP's entry facilitated an exit for an existing investor – Everstone Group and EQT, respectively. These activities underline the continued appeal of sponsor-to-sponsor transactions even as assorted economic concerns make buyers gun-shy. As of mid-September, deals of this nature amounted to USD 21.8bn, short of the record 12-month figure of USD 35.9bn set last year, but close enough to the 2017 and 2018 totals that second place should be in reach come December. Nearly half of this deal flow, in US dollar terms, has been in Australia, which accounts for five of the eight largest deals. Some of these involved infrastructure or new infrastructure assets, but there also traditional PE deals like Greencross (TPG Capital to AustralianSuper and Healthcare of Ontario Pension Plan), iNova Pharmaceuticals (The Carlyle Group and Pacific Equity Partners, PEP, to TPG), and La Trobe Financial Services (The Blackstone Group to Brookfield Asset Management). In the past week, PAG announced the acquisition of two food businesses from local managers – Patties Foods (PEP) and Vesco Foods (Catalyst Investment Managers).

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.