Weekly digest - September 14 2022

|

TALKING POINTS

AVCJ AWARDS 2022 - NOMINATIONS CLOSE SEPTEMBER 22

Industry participants have until September 22 to put forward firms, fundraises, investments, and exits they believe worthy of consideration. For more information, go to www.avcjforum.com/awards.

|

|

By the Numbers

AVCJ RESEARCH

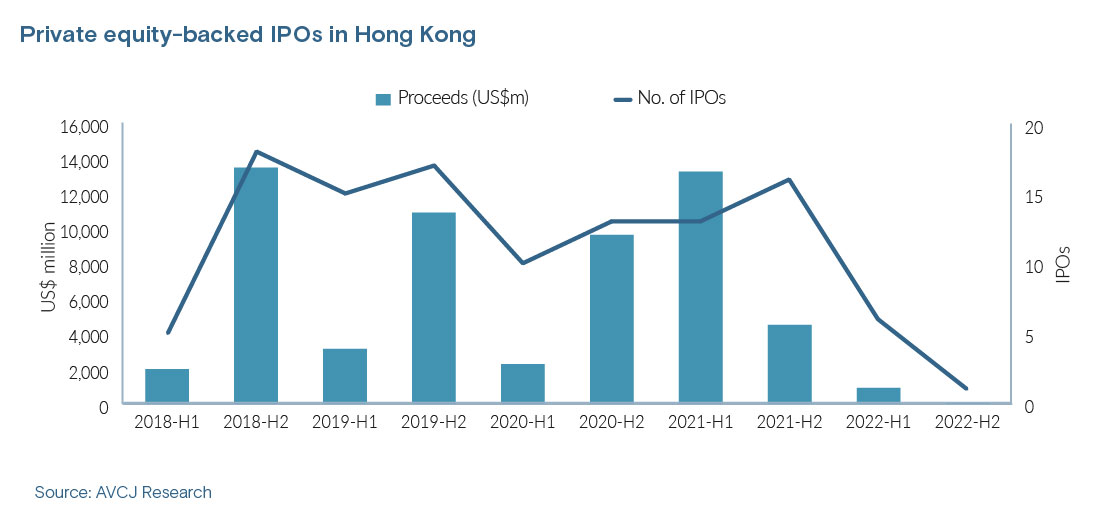

A ROCKY ROAD IN HONG KONG

Does the flurry of new filings by private equity-backed companies - including high-profile names like Leapmotor, Fourth Paradigm, and Keep - suggest that Hong Kong is getting over its IPO funk? It remains to be seen, but 2022 has been dismal to date. According to AVCJ Research, there have only been about half a dozen offerings by companies with financial sponors with total proceeds falling short of USD 1bn. This compares to USD 17.7bn from around 30 IPOs in 2021. Most recently, Dingdang Health made it to the finish line, albeit with far fewer proceeds than expected when the company first sought to list last year (it was rejected). Others, however, have fallen short, with YH Entertainment pulling the plug during the pricing process.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.