Weekly digest - September 07 2022

|

TALKING POINTS

AVCJ AWARDS 2022 - SUBMIT YOUR NOMINATIONS

Industry participants have until September 22 to put forward firms, fundraises, investments, and exits they believe worthy of consideration. For more information, go to www.avcjforum.com/awards.

|

|

By the Numbers

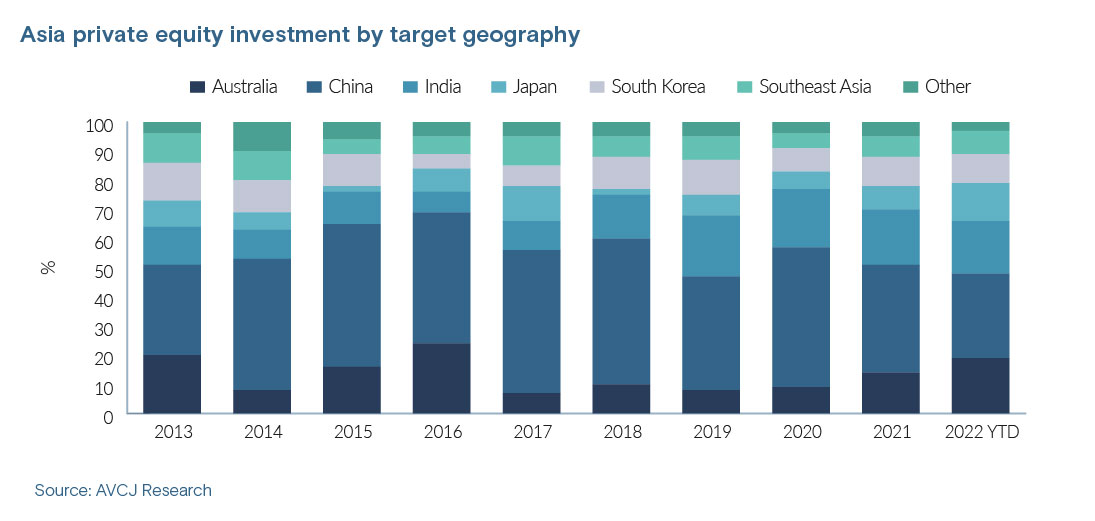

AVCJ RESEARCH

JAPAN IN SIX TRENDS

To cpincide with the upcoming AVCJ Japan Forum (see here or the full special issue) ...

Carve-outs: Going large Toshiba wouldn't be a corporate carve-out in the conventional sense, but many of the operational challenges are similar. It demonstrates private equity's willingness to take on larger and more complex challenges involving corporate Japan. SoftBank: Blurred vision? SoftBank Group invests globally through its Vision Fund series, but recent sub-par performance may lead to reductions in overheads and a less aggressive approach to deployment. Vision Fund 2 is already writing smaller cheques at earlier stages than its predecessor. Buyout funds: Keen to deploy With uncertainty looming over China, pan-Asian managers may have to rethink their likely geographical deployment over the next few years. Ramping up investment in mature markets like Japan where meaningful sums can be put to work in leveraged buyouts is one answer. Middle market: New blood needed? Robust performance by Japan's middle-market managers hasn't translated into a glut of new GPs. The dynamics are gradually changing, with a few more spinouts from established firms and a few more captives going independent. It remains to be seen whether attract global LP support. Technology: Growth-stage agenda Growth-stage technology investment in Japan has not ramped up to the same extent as other markets in the region because a lack of pre-IPO funding means start-ups go public earlier. Global growth investors, local newcomers, and government policy are helping redress the balance. Renewables: Investing towards net-zero Japan must ease reliance on fossil fuels and decarbonise real estate, transportation, and industrials to achieve its net-zero emissions target. Investors in renewables are bullish on the market, citing the impact of regulations enacted several years ago and the prospects in areas like offshore wind.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.