Weekly digest - August 17 2022

|

SPECIAL ISSUE: ENERGY TRANSITION

|

|

By the Numbers

AVCJ RESEARCH

EV AND THE REST

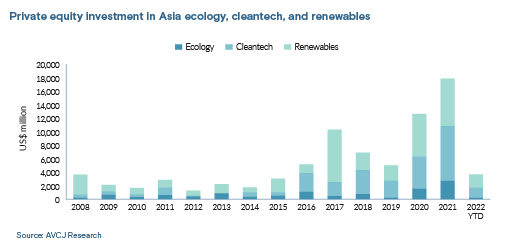

PE investment in Asian ecology, cleantech, and renewables used to be characterised by infrequent big bets on wind and solar. This included a pre-global financial crisis surge in China driven by low-cost local manufacturing and foreign subsidies.

The landscape shifted in 2016 when investment surpassed USD 5bn for the first time. A year later, it topped USD 10bn and stayed there - the annual average for 2017-2021 is USD 10.5bn. It is another China-centric story, built initially on electric vehicles (EV) and then stretching along the EV value chain. Having historically played second fiddle to renewables, cleantech was the dominant category in four of the last six years.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

The AVCJ Weekly Digest will skip an issue next week. It returns on August 31.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.