Weekly digest - July 13 2022

|

By the Numbers

AVCJ RESEARCH

ON THE FARM

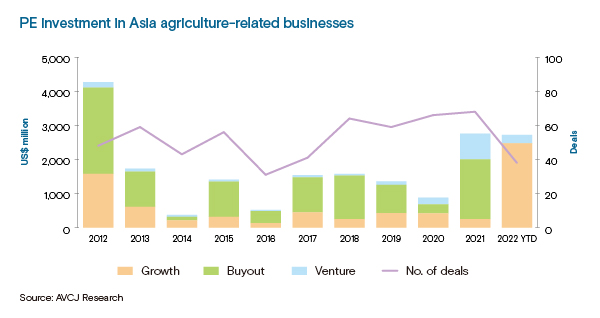

Two deals in a matter of days involving B2B marketplaces targeting the food supply chain highlighted robust investor interest in agriculture. Nearly USD 2.8bn has been deployed in 2022 to date, equal to the 12-month total for 2021, and all the capital has gone into early and growth-stage plays, according to AVCJ Research.

The sector is notoriously broad. Even the two recent B2B marketplace investees are somewhat different. India's Vegrow is a classic matchmaker, helping farmers sell their crops into formal distribution channels. Indonesia's AgriAku has a similar tech offering, but targets small-scale retailers who sell agricultural inputs to farmers. Vegrow secured a USD 25m Series B round led by Prosus Ventures. AgriAku closed a USD 35m Series A with Alpha JWC Ventures assuming the lead investor role. Roughly half of PE investment in Asian agriculture since 2012 has gone into buyouts. Many of the largest deals have involved forestry and food processing assets in Australia and New Zealand. Meanwhile, in the upper end of the growth space, there are plenty of investments in Chinese dairy farm operators and pet food producers. The outsized 2022 total is underpinned by the acquisition of a minority stake in Australian pet products and services retailer Greencross. However, the increase in overall deal flow in recent years can be traced to an influx of VC deals involving tech-enabled start-ups in emerging economies – marketplaces, brands, e-commerce.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.