Weekly digest - July 06 2022

|

By the Numbers

AVCJ RESEARCH

THE SEQUOIA FACTOR

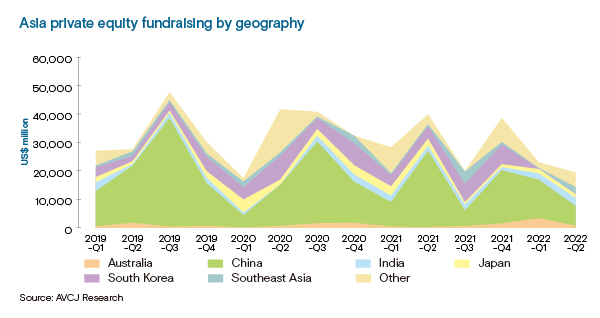

Viewed on a quarter-by-quarter basis, Asia private equity fundraising has proved volatile during the COVID-19 period. It is likely a result of a widening of the gap between popular and less popular managers, leading to intermittent large outliers against a backdrop of general difficulty.

Sequoia Capital China's USD 8.8bn fundraise will drive up the headline number for the third quarter. As for the second, it was done from an already disappointing first three months of the year. A total of USD 19.4bn was raised, according to provisional data from AVCJ Research. Commitments to China-focused managers fell by more than half on the previous quarter USD 6.9bn, while India and Southeast Asia both posted increases. They were helped by Sequoia's local franchises announcing final closes. The India team raised USD 2bn and the Southeast Asia operation – secured USD 850m.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.