Weekly digest - June 29 2022

|

By the Numbers

AVCJ RESEARCH

FALLOUT FROM THE SELLOFF

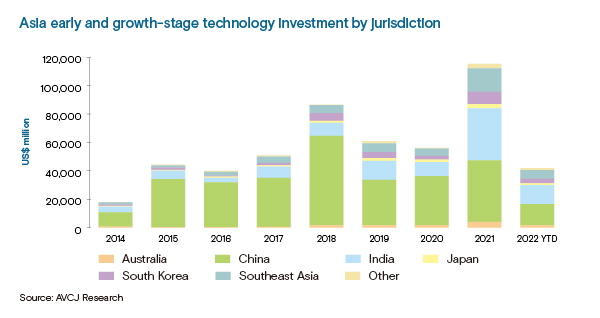

Approaching the halfway point of 2022, early and growth-stage investment in Asia's technology sector stands at USD 41.9bn – far off the record pace set in 2021 but comfortably ahead of the two, less extraordinary, prior years.

Meanwhile, the geographical realignment continues. China routinely accounted for three-quarters of minority equity commitments to the sector until last year, when its share fell to 38% on the back of significant regulatory uncertainty. India and Southeast Asia came to the fore, with 32% and 16%, respectively. It's much the same for 2022 to date: China 36%, India 32%, Southeast Asia 15%. More telling – and still provisional – are the numbers for the second quarter, which coincided with the global sell-off in technology stocks. Just over USD 15bn has been deployed, down from USD 26.3bn in the first quarter. Unsurprisingly, growth-stage investment saw the biggest decline, falling by more than half to USD 7bn. China has plummeted from USD 11.2bn to USD 3.8bn, India from USD 8.1bn to USD 3.4bn. Yet Southeast Asia has demonstrated some resilience – across early-stage and growth transactions – rising from USD 2.8bn to USD 3.4bn. E-commerce has been prevalent in the past week, with the likes of RPG Commerce, ShopBack, and OnPoint all closing new funding rounds.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.