Weekly digest - June 08 2022

|

By the Numbers

AVCJ RESEARCH

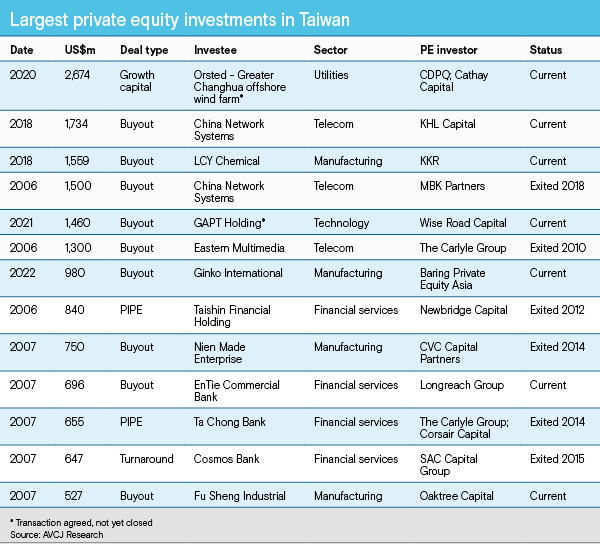

TARGETING TAIWAN

The best-known set of statistics that capture the mixed fortunes of buyout investors in Taiwan begins in 2006-2007 with the territory rising to become one of Asia's most active markets, with USD 9.4bn put to work. It ends with Taiwan retreating into relatively obscurity following the global financial crisis and hitting rock bottom in 2012 when only USD 57m was invested. It ranked 16th by transaction value in Asia.

Deal flow remains patchy, but at least one longstanding private equity gripe appears to be dissipating. Baring Private Equity Asia (BPEA) recently acquired listed contact lens manufacturer Ginko International at a valuation of NTD 27.2bn (USD 980m) – a rare instance of a private equity firm delisting a company from the Taipei Exchange. Take-privates historically have proved challenging in Taiwan, with the government either blocking deals or withholding approval until the financial sponsor gave up. Electronic components supplier Yageo Corporation made for a controversial case study in 2011: a majority of minority shareholders accepted KKR's buyout offer, yet the deal was vetoed – supposedly to protect minority shareholders. KKR made a breakthrough in 2018 with the NTD 47.8bn take-private of LCY Chemical Corp. Ginko now sits alongside it as one of the largest-ever PE investments in Taiwan. Scanning the list, it is worth noting exits can be just as problematic as investments. Of the 13 transactions of USD 500m or more in AVCJ Research's records, six have been exited after holding periods of 7-12 years. China Network Systems, Eastern Multimedia, Ta Chong Bank, and Cosmos Bank – each one experienced multiple thwarted exit processes, with approvals often the stumbling block. Last year, The Longreach Group agreed to sell EnTie Commercial Bank, potentially ending a 14-year journey marked by a successful turnaround and several frustrated exit attempts. Mark Chiba, group chairman of Longeach, said : "If the shareholder votes are respected, it will close. If the interests of Taiwan's financial system are respected, it will close. What I'm fighting against is the process getting subverted by local interest groups trying to block or delay regulatory approval."

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.