Weekly digest - June 01 2022

|

By the Numbers

AVCJ RESEARCH

CLEAN ENERGY AGENDA

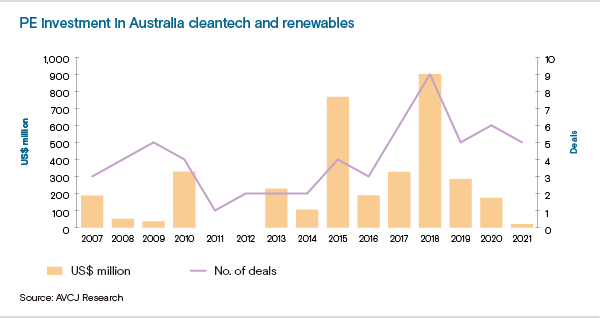

The Astrea The low point for renewable energy in Australia came during the Abbott administration of 2013-2015. The industry seemed to be under constant threat: not only were key government agencies that drive investment in renewables slated for closure, but a proposal was even floated to eliminate the country's renewable energy target.

Subsequent administrations have, to varying degrees, been less hawkish on the environment. Clean energy accounted for 32.5% of Australia's electricity supply in 2021 and private capital is increasingly prominent in the industry. Annual private equity investment alone has averaged USD 380m over the past seven years, a fourfold increase on the preceding seven years, according to AVCJ Research. Large-scale renewables deals skew the headline numbers, but at the same time, these numbers often fail to capture the full breadth of sustainability-related investment activity. Just in the past week, deals have been announced involving software providers that help companies manage carbon in agricultural supply chains and enable utilities to prepare for and withstand extreme weather events. Mounting public dissatisfaction on climate change policy arguably contributed to the outcome of the recent federal election. The incumbent Morrison administration set a net-zero emissions target but was criticised for failing to back it up with meaningful policies; newly elected Prime Minister Anthony Albanese has placed climate change at the top of his agenda. Will we see a renewed surge in private investment?

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.