Weekly digest - May 04 2022

|

LP INTERVIEW

BRITISH INTERNATIONAL INVESTMENT

British International Investment, formerly CDC Group, is doubling down on an already massive Asia program as it heeds the call for climate action. Specialist funds are the priority. British International Investment, formerly CDC Group, is doubling down on an already massive Asia program as it heeds the call for climate action. Specialist funds are the priority.Q&A

MICHAEL YAO OF ZWC PARTNERS

Michael Yao, a partner at ZWC Partners, discusses valuations, exit obstacles, and artificial intelligence in China, as well as the scope for applying China knowledge in Southeast Asia. Michael Yao, a partner at ZWC Partners, discusses valuations, exit obstacles, and artificial intelligence in China, as well as the scope for applying China knowledge in Southeast Asia.FUND FOCUS

MASSMUTUAL VENTURES WIDENS REMIT

Having started a Southeast Asia specialist, MassMutual Ventures has broadened its regional coverage to include everything outside of China. Europe is also part of the equation for Fund III. Having started a Southeast Asia specialist, MassMutual Ventures has broadened its regional coverage to include everything outside of China. Europe is also part of the equation for Fund III.DEAL FOCUS

LAIYE LEVERAGES EUROPEAN CONNECTIONS

M&A helped Chinese artificial intelligence start-up Laiye develop its product and gain a foothold in Europe. With more than USD 160m in Series C funding, the company is aggressively targeting global expansion. M&A helped Chinese artificial intelligence start-up Laiye develop its product and gain a foothold in Europe. With more than USD 160m in Series C funding, the company is aggressively targeting global expansion. |

|

By the Numbers

AVCJ RESEARCH

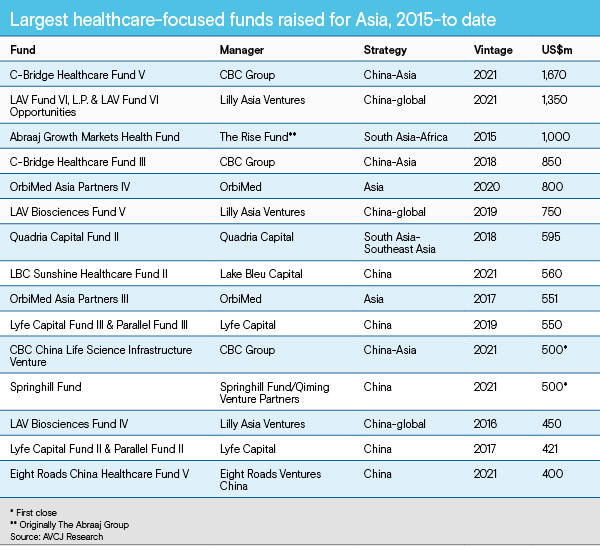

AN ESTABLISHED SPECIALISM?

Three funds of USD 1bn or more have been raised for deployment in Asia's healthcare sector. Two of them achieved final closes in the past 18 months: Lilly Asia Ventures (USD 1.35bn) and CBC Group (USD 1.67bn). Quadria Capital wants to join this select group, having said it will seek up to USD 1bn for its third fund. The firm, which invests across South Asia and Southeast Asia, raised USD 595m last time around. CBC could make it five, should its China healthcare infrastructure fund close on target at USD 1.5bn. Seven of the 15 largest Asia healthcare vehicles to reach partial or final closes since 2015 did so in the past two years. There are six from the 2021 vintage alone, suggesting that healthcare as a specialisation within private equity is gaining traction.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.