Weekly digest - March 23 2022

|

Q&A

JOHN KIM OF AMASIA

MJohn Kim, co-founder of Singapore and US-based Amasia, explains how a climate impact thesis "swallowed up" his generalist VC firm and shifted its focus from technology to behaviour MJohn Kim, co-founder of Singapore and US-based Amasia, explains how a climate impact thesis "swallowed up" his generalist VC firm and shifted its focus from technology to behaviourDEAL FOCUS

MEDLINK CHASES GLOBAL ADC OPPORTUNITY

The Medilink Therapeutics team spun out from Kelun-Biotech to develop antibody drug conjugates capable of competing with the world's best. Its USD 70m Series B will support the pursuit of this goal. The Medilink Therapeutics team spun out from Kelun-Biotech to develop antibody drug conjugates capable of competing with the world's best. Its USD 70m Series B will support the pursuit of this goal.DEAL FOCUS

BAZAAR, ZAYN AND PAKISTAN'S BREAKOUT MOMENT

Bazaar, a B2B logistics and financial services start-up, is putting Pakistan on the map for brand-name global VC investors for the first time. One of its key local backers, Zayn Capital, is doing the same. Bazaar, a B2B logistics and financial services start-up, is putting Pakistan on the map for brand-name global VC investors for the first time. One of its key local backers, Zayn Capital, is doing the same.DEAL FOCUS

ZELLER MAKES ITS PRESENCE FELT IN AUSTRALIA

Less than a year after launching its digital payments-led product suite, Australia-based Zeller has accumulated 11,000 merchant customers, raised over USD 100m, and achieved a USD 750m valuation. Less than a year after launching its digital payments-led product suite, Australia-based Zeller has accumulated 11,000 merchant customers, raised over USD 100m, and achieved a USD 750m valuation. |

|

By the Numbers

AVCJ RESEARCH

A SHORTCUT TO SCALE

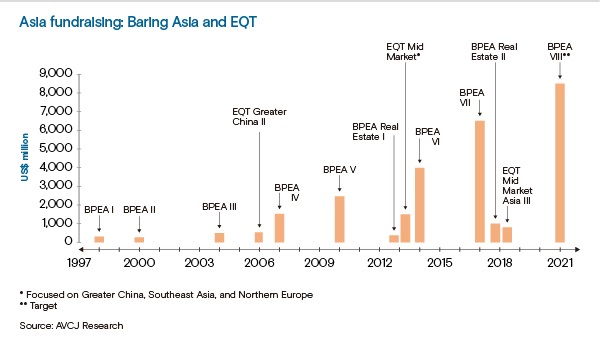

"Our business is all about scale," Jean Eric Salata, CEO of Baring Private Equity Asia (BPEA) told AVCJ last week. "When you grow in fund size from USD 2.5bn to USD 4bn to USD 6.5bn and now the target for the new fund is USD 8.5bn and we are likely to exceed that, you end up with a very different economic profile to the business. We have also scaled the real estate funds since then."

EQT's EUR 6.8bn (USD 7.5bn) acquisition of BPEA is driven by a desire for a scaled business in Asia without the protracted heavy lifting of an organic build-out. The valuation represents a 6x increase from 2016 when Affiliated Managers Group bought a 15% stake in BPEA. But since then, the firm's fee-paying assets under management have grown approximately 5x to USD 17.7bn. Here is a snapshot of how and when this expansion was achieved, along with EQT's own Asia fundraising record.  All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits. |

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.