Weekly digest - December 01 2021

|

TALKING POINTS

FROM $100B to $1T

"While $100 billion looks like a big number, because 15 years ago it was $10 billion, it's still a small part of the overall industry. We have projections for $500 billion over the medium term," Francois Aguerre, head of origination at Coller Capital, told AVCJ last month in reference to secondary volume likely reaching $100 billion in 2021. In depth

|

|

PORTFOLIO

DYMON ASIA AND SINGAPORE'S AMES

For all the hubbub about digital businesses taking flight during the pandemic, few categories saw as much upside as traditional medical waste disposal For all the hubbub about digital businesses taking flight during the pandemic, few categories saw as much upside as traditional medical waste disposalDEAL FOCUS

PERMIRA PASSES TRICOR TO BARING

Permira helped Tricor consolidate its position in Asian corporate services and upgrade its product offering. Under Baring Private Equity Asia's ownership, the CEO wants to build a $10 billion company. Permira helped Tricor consolidate its position in Asian corporate services and upgrade its product offering. Under Baring Private Equity Asia's ownership, the CEO wants to build a $10 billion company.FUND FOCUS

A91 BASKS IN INDIA'S AFTERGLOW

Having increased its Fund II hard cap to $550 million in response to investor demand, the Indian manager is ready to address an Indian market that is increasingly digital, VC-exposed, and expensive. Having increased its Fund II hard cap to $550 million in response to investor demand, the Indian manager is ready to address an Indian market that is increasingly digital, VC-exposed, and expensive.DEAL FOCUS

SERVING BIRYANI AT SCALE

With biryani the dish of choice on India's food delivery apps, Biryani By Kilo is looking to build out a standardized cloud kitchen model. It has $35 million in Series B funding to pursue this ambition. With biryani the dish of choice on India's food delivery apps, Biryani By Kilo is looking to build out a standardized cloud kitchen model. It has $35 million in Series B funding to pursue this ambition. |

|

By the Numbers

AVCJ RESEARCH

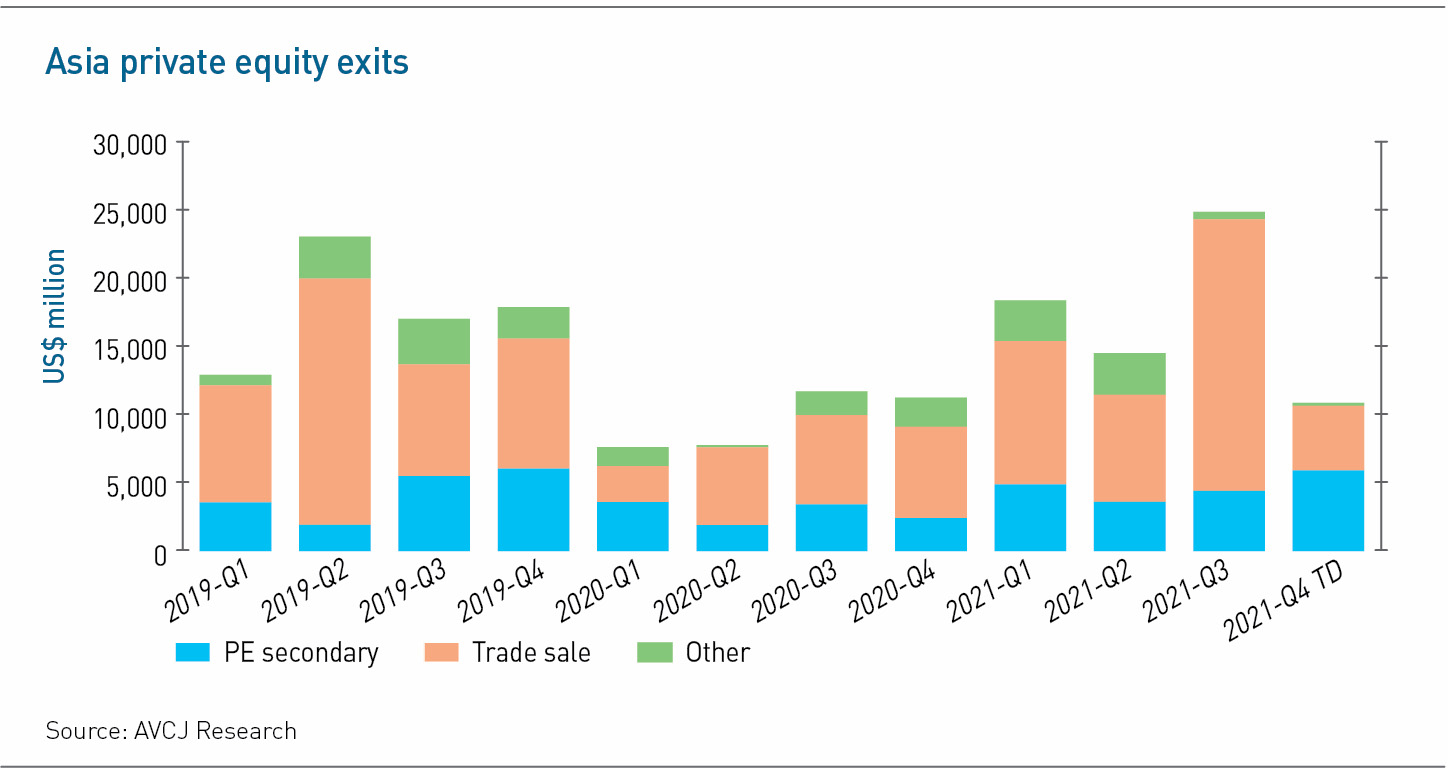

SPONSORS GO LARGE

In the first three months of 2020, quarterly PE secondary sales in Asia outpaced trade sales for the first time in eight years. There were extenuating circumstances. The world was in the grip of COVID-19, strategic investors were spooked, and trade sales were at a post-global financial crisis low. Activity has rebounded, but it only surpassed pre-COVID levels in the third quarter of 2021, spurred by some big financial technology deals. The fourth quarter still has one month to run, but secondary sales are currently ahead of trade sales, on $5.9 billion versus $4.7 billion. The likes of Tricor Group and Icon Group move the needle, but there has been a steady stream of mid- to large-cap transactions, ranging from Nucleus Network to A Twosome Place.  All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits. |

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.