Weekly digest - November 11 2021

| AVCJ HONG KONG FORUM SPECIAL ISSUE |

|

ANALYSIS

HNWIs & PRIVATE EQUITY: ACCESS ALL AREAS?

The private equity industry wants more efficient and inclusive ways to raise high net worth money than private bank feeder funds. Technology, in different ways, might provide the answer. The private equity industry wants more efficient and inclusive ways to raise high net worth money than private bank feeder funds. Technology, in different ways, might provide the answer.ANALYSIS

HNWIs & PRIVATE EQUITY: THE ROAD TO RETAIL

From B2C aggregation platforms to nascent blockchain-based products, solutions that bring alternatives to the mass market are emerging. Providers prefer to be labeled enablers than disrupters. From B2C aggregation platforms to nascent blockchain-based products, solutions that bring alternatives to the mass market are emerging. Providers prefer to be labeled enablers than disrupters.Read further:

|

|

Q&A

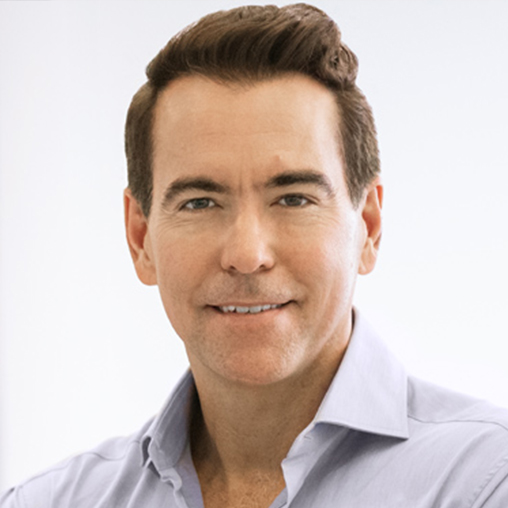

ORLANDO BRAVO OF THOMA BRAVO

Orlando Bravo, founder and managing partner of Thoma Bravo, which claims to be the largest PE investor in software globally, on adding value to SaaS businesses, the rise of blockchain, and opportunities in Asia. Orlando Bravo, founder and managing partner of Thoma Bravo, which claims to be the largest PE investor in software globally, on adding value to SaaS businesses, the rise of blockchain, and opportunities in Asia.Q&A

ANDREAS ASCHENBRENNER & SOPHIE WALKER OF EQT

In the past month, EQT has launched an impact fund with a difference and adopted science-based targets for emissions reduction. Andreas Aschenbrenner, deputy head of EQT Future, and Sophie Walker, head of sustainability for private capital, explain why. In the past month, EQT has launched an impact fund with a difference and adopted science-based targets for emissions reduction. Andreas Aschenbrenner, deputy head of EQT Future, and Sophie Walker, head of sustainability for private capital, explain why.Q&A

FRANCOIS AGUERRE OF COLLER CAPITAL

Francois Aguerre, head of origination at Coller Capital, on the march towards a $500 billion global secondaries market, the rise of GP-led transactions, and the implications of more permanent capital. Francois Aguerre, head of origination at Coller Capital, on the march towards a $500 billion global secondaries market, the rise of GP-led transactions, and the implications of more permanent capital. |

|

ANALYSIS

HONG KONG IPOs: WINNER BY DEFAULT

New York's loss is expected to be Hong Kong's gain as regulatory and political turbulence drives Chinese start-ups to look for alternative listing destinations – unless valuations become a sticking point. New York's loss is expected to be Hong Kong's gain as regulatory and political turbulence drives Chinese start-ups to look for alternative listing destinations – unless valuations become a sticking point.ANALYSIS

SOUTHEAST ASIA IPOs: OPPORTUNITY KNOCKS

A breakthrough offering in Indonesia and regulatory progress in Singapore highlight Southeast Asia's growing viability as a tech IPO market. It's unclear how well this is being communicated globally. A breakthrough offering in Indonesia and regulatory progress in Singapore highlight Southeast Asia's growing viability as a tech IPO market. It's unclear how well this is being communicated globally.ANALYSIS

NORTH ASIA IPOs: WELCOME ERUPTIONS

A steady rhythm of small and mid-sized IPOs in North Asia is now being punctuated by globally noticeable events. Valuations are up, but Korean and Japanese investors are game. A steady rhythm of small and mid-sized IPOs in North Asia is now being punctuated by globally noticeable events. Valuations are up, but Korean and Japanese investors are game.Read further:

|

|

The AVCJ Weekly Digest will skip an issue next week. It returns November 24.

|

|

By the Numbers

AVCJ RESEARCH

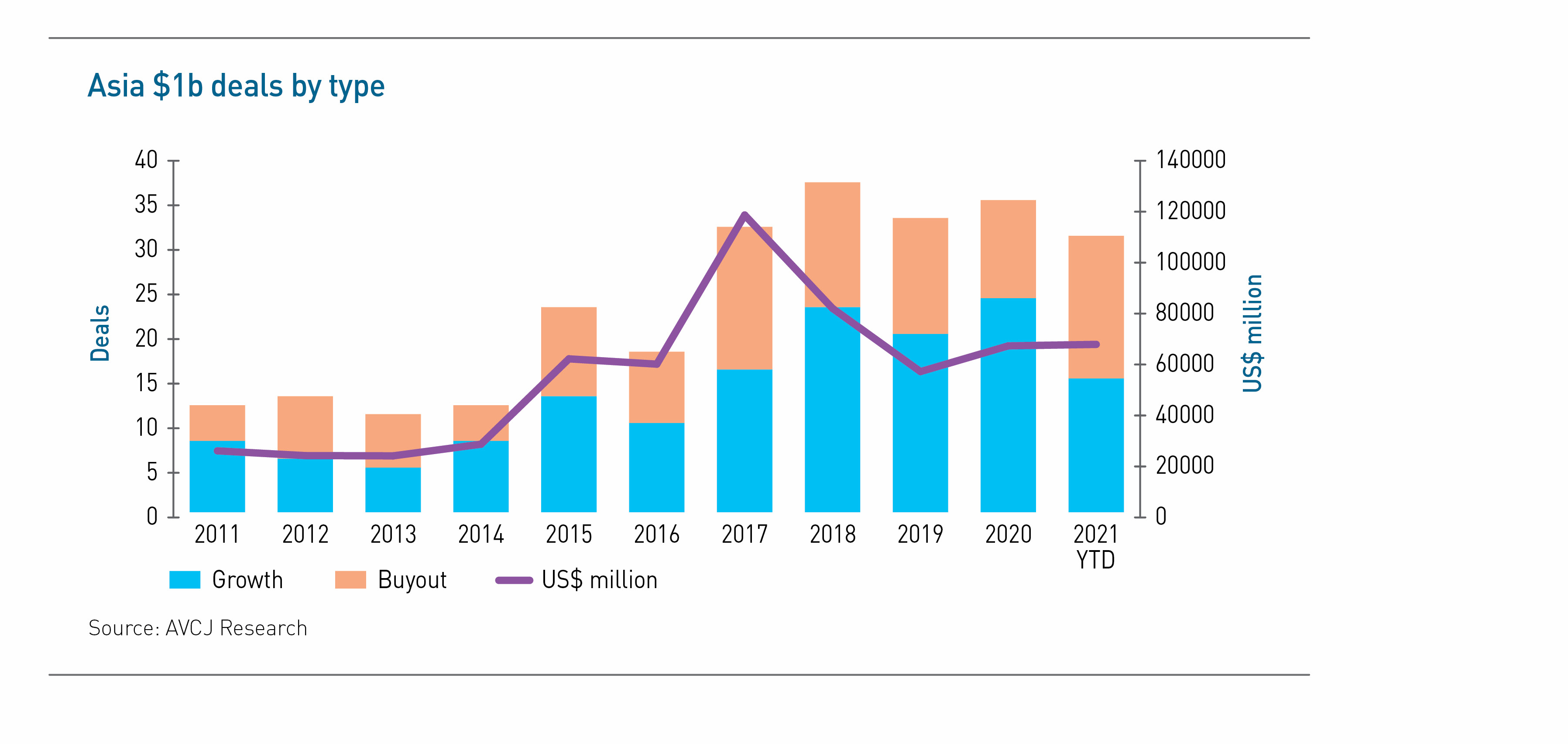

BIG SPENDERS

In 2017, billion-dollar-plus private equity deals stepped up a level in Asia. Previously, there were seldom more than a dozen in any given year. More than 30 were announced in 2017 and the region hasn't looked back. The emergence of big-ticket carve-out opportunities, especially in markets like Japan and Korea, is a contributing factor. However, growth-stage technology deals typically make up the largest share. Perhaps that will change in 2021. With uncertainty clouding China's technology sector, buyouts currently edging minority transactions by 16 to 15.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.