Weekly digest - October 27 2021

|

TALKING POINTS

JAPAN IN SIX TRENDS

To coincide with this week's AVCJ Japan Forum...

|

|

LP INTERVIEW

AUSTRALIA'S CAMBOOYA

The family office that represents members of Australia's Fairfax family launched its private equity program six years ago. Venture capital, growth equity, and co-investment are increasingly on the agenda. The family office that represents members of Australia's Fairfax family launched its private equity program six years ago. Venture capital, growth equity, and co-investment are increasingly on the agenda.DEAL FOCUS

BIOTECH GETS MORE CEREBRAL

As opportunity appears to plateau in the most popular biotech segments, brain health could come to the fore. Neurology specialist Cerecin is tracking greater interest amid industry traction in the lab. As opportunity appears to plateau in the most popular biotech segments, brain health could come to the fore. Neurology specialist Cerecin is tracking greater interest amid industry traction in the lab.DEAL FOCUS

INDIA'S HUBILO RISES FROM ASHES

An early mover in last year's virtual events boom, Hubilo is attracting global investors with an explosive growth story and a sense of empathy for a disrupted industry. An early mover in last year's virtual events boom, Hubilo is attracting global investors with an explosive growth story and a sense of empathy for a disrupted industry.DEAL FOCUS

CRYPTO PROMISES FRICTIONLESS TRANSFERS

Hong Kong's XanPool is tapping a growing universe of cryptocurrency holders to speed up traditional money transferring processes while reducing costs. Valar Ventures offers support. Hong Kong's XanPool is tapping a growing universe of cryptocurrency holders to speed up traditional money transferring processes while reducing costs. Valar Ventures offers support. |

|

By the Numbers

AVCJ RESEARCH

GOING GREEN

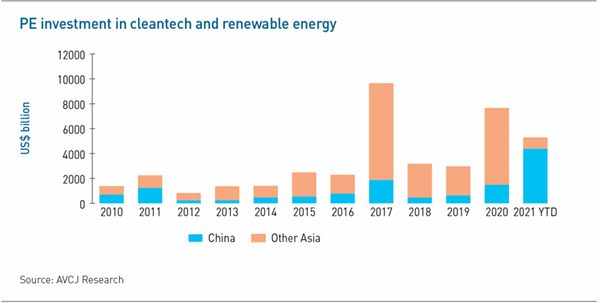

Investment in cleantech and renewable energy in Asia is on a general upward trend, but China seldom accounts for the lion's share. It has averaged 22.5% over the past eight years. But 2021 will be different. Of the $5.3 billion deployed to date, $4.4 billion has gone to China. Investments in electric vehicle battery makers like Svolt Energy Technology have moved the needle, but in the past week Primavera Capital Group and Affinity Equity Partners have made their mark in renewables. Primavera committed $600 million to Envision Group, which primarily manufactures wind turbines, while Affinity invested $360 million in support of a solar roll-out by Towngas China. Both noted China's bold ambition to rebalance its energy mix away from coal-fired power and towards renewables. At a time when investors are wary of unforeseen regulatory action, both are examples of aligning with government policy.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.