Weekly digest - October 13 2021

|

TALKING POINTS

CHINA IN SIX TRENDS

To coincide with this week's AVCJ China Forum...

|

|

ANALYSIS

3Q ANALYSIS: INDIA ADVANCES

India technology investment continues to ramp up as China flatlines; international payments M&A drives Asia trade sale revival, but IPOs slump; fundraising remains slow. India technology investment continues to ramp up as China flatlines; international payments M&A drives Asia trade sale revival, but IPOs slump; fundraising remains slow.Q&A

JUSTIN RYAN OF GLOW CAPITAL PARTNERS

Having teamed up with the founder of Adore Beauty to launch Glow Capital Partners, Justin Ryan discusses life after Quadrant Private Equity, growth-stage investment in Australia, and gender balance. Having teamed up with the founder of Adore Beauty to launch Glow Capital Partners, Justin Ryan discusses life after Quadrant Private Equity, growth-stage investment in Australia, and gender balance.FUND FOCUS

YUNQI REAFFIRMS ITS ENTERPRISE FOCUS

Yunqi Partners was the first Chinese GP dedicated to enterprise services and now claims to be the largest early-stage investor in the space. SaaS, in various forms, will account for the bulk of Fund III. Yunqi Partners was the first Chinese GP dedicated to enterprise services and now claims to be the largest early-stage investor in the space. SaaS, in various forms, will account for the bulk of Fund III.DEAL FOCUS

DIGITAL BROKERAGE AJAIB FINDS THE RIGHT FIT

Ajaib grew from nothing to become Indonesia's fifth-largest stockbroker by volume in the space of six months. The newly appointed unicorn is now raising capital just as quickly. Ajaib grew from nothing to become Indonesia's fifth-largest stockbroker by volume in the space of six months. The newly appointed unicorn is now raising capital just as quickly. |

|

By the Numbers

AVCJ RESEARCH

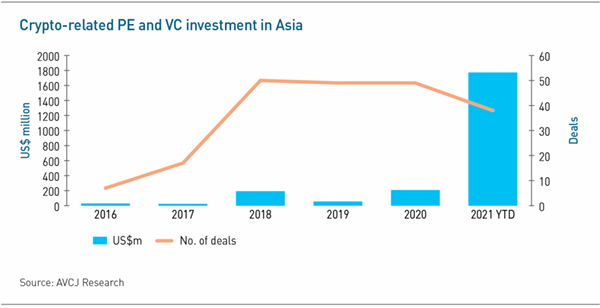

CROWNING CRYPTO

Andreessen Horowitz has arguably embraced crypto more readily than any other mainstream US venture capital firm. It has now followed this interest into Asia with investments in Vietnam-based non-fungible token (NFT) gaming start-up Axie Infinity and Indian crypto exchange Coinswitch Kuber. Participation by Andreessen might help legitimize the Asia crypto opportunity, but capital is already flowing into the space at record pace. In 2018, deal count rose from a handful to 50 and it remains around that level. Last year, capital commitments exceeded $200 million for the first time. The running total for 2021 is $1.77 billion. Three-quarters of this has gone to three companies – Axie Infinity, Coinswitch, and Hong Kong-headquartered crypto exchange FTX – but there is also a scattering of deals in the $30-100 million range.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits. All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.