By the Numbers

AVCJ RESEARCH

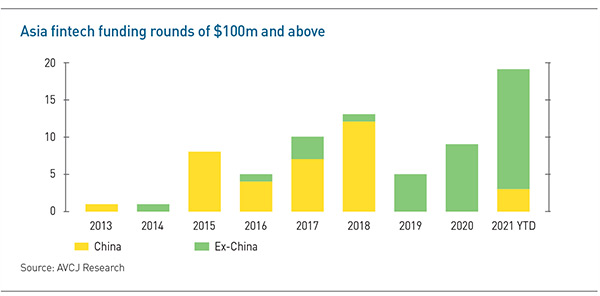

CHINA EXODUS

Until two years ago, growth-stage investment in Asian financial technology was all about platforms, P2P payments, and China. There were 38 funding rounds of $100 million or more between 2013 and 2018. All but six involved China-focused businesses, and four of those were based in Hong Kong. Since 2019, China represents three out of 33, as India and Southeast Asia have come to the fore. No single deal has surpassed $1 billion, but investment activity reflects a broader set of business models as well as a wider geographic spread. Payments still dominates – though payments providers are busy diversifying – but it sits alongside the likes of buy now, pay later, insurance, and cryptocurrency exchanges.

|