By the Numbers

AVCJ RESEARCH

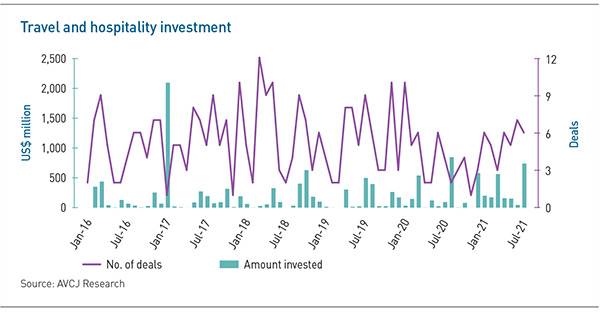

BLOOD IN THE STREETS

In the past five years, only six months have seen more than $500 million of private equity and venture capital investment in Asian travel and hospitality businesses. (That's excluding January 2017, when the McDonald's business in mainland China and Hong Kong - hospitality in the broadest sense of the word - was acquired for $2.1 billion.) Of these six standout months, five have been during the lockdowns and grounded flights of the pandemic. Last month was one of the most active, with $735.1 million deployed across six deals, including two hotel groups: Japan's Fujita Kanko and India's GoStops Hospitality.

|