Energy start-ups: Disencumbering incumbents

Digital start-ups play a crucial role in energy transition and therefore represent a significant investment opportunity. The best approaches consider human nature and social themes as well as widgets

The financial motivation for pursuing energy transition via ancillary digital plays rather than core energy production technology is fundamentally strategic. The former approach yields a technology-style return more familiar to venture capitalists, while the latter leans infrastructure. But this is not a strictly financial megatrend.

The urgency for impact that ultimately drives the energy transition theme has also contributed to the logic of gaining exposure to the sector via digital models rather than heavy assets. This was the thinking behind the establishment of Germany's Future Energy Ventures in 2016 by E.ON, one of Europe's largest utilities.

Jan Lozek, Future Energy's founder, estimates that the energy transition technology market has grown from USD 6bn when the VC was launched to USD 30bn currently. He believes this represents mainstream acceptance of the idea that digital energy services are more essential to meeting short-term climate goals than bringing forward alternative fuels or additional infrastructural cleantech.

"For the next 5-10 years, we should focus on the financial and impact opportunity on software and digital solutions and not hydrogen or new battery technologies," Lozek said. "We should start with what we have on hand. The commercialisation of new technologies like hydrogen will come later, say, 2035 or 2040. That's why we're focusing on software."

Concept mapping

A galaxy of widely differentiating business models defines this space, but it is not unreasonable to simplify the opportunity set into two styles of start-up: those that disrupt industry incumbents and those that circumvent them.

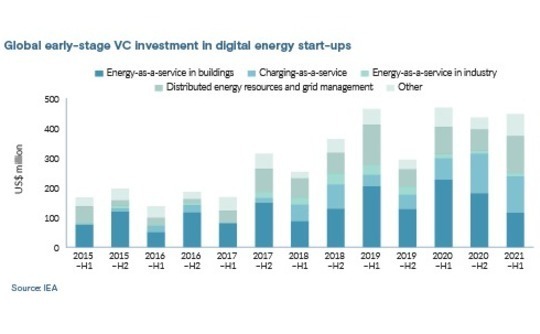

The International Energy Agency (IEA) places them into a handful of major categories, including energy-as-a-service (EaaS) in buildings, charging-as-a-service, EaaS in industry, and distributed energy resources (DER) and grid management.

An early preference among investors for EaaS in buildings has gradually diversified in recent years, although EaaS in industry appears to remain underpenetrated. In the first half of 2021, global early-stage VC deployment amounted to USD 115m (EaaS in buildings), USD 122m (charging-as-a-service), USD 10m (EaaS in industry), and USD 126m (DER and grid management), according to IEA.

Amasia, a climate-focused investor based in Singapore and the US, sees opportunity for energy sector software in the fact that algorithms are better than people at precisely balancing supply and demand. It further extends the boundaries of the opportunity set with four investments across carbon accounting and carbon offset marketplaces.

The key diligence considerations in these models are comprehensiveness in terms of emissions coverage, credibility of the datasets and methodologies used, ease of use, and competitiveness with existing services. But the most critical factor may be non-technical: understanding end-user mindsets.

"The important thing is that business models for reducing energy consumption encourage the consumer to change their attitudes and behaviours towards saving energy," said Ramanan Raghavendran, a managing partner at Amasia. "It shouldn't feel like a massive financial sacrifice is being made, and often the customer can even see a net financial gain."

The most direct way for asset-light start-ups to get exposure to energy transition is through servicing renewable power generation companies, and few need more servicing than wind farms.

Turbine blades suffer intense wear-and-tear and are more expensive than almost any ground-based equipment – and, unlike solar panels, they must be idle during maintenance runs. This puts significant pressure on doing inspections quickly and accurately in a dangerous, 300-foot-high environment.

Korea's Nearthlab, which makes AI-enabled autonomous drones exclusively for the wind industry, says this backdrop has helped it grow 200% last year and secure contracts with several global wind companies. Its investors include Company K Partners, Stonebridge Capital, Mirae Asset Capital, SBI Investment Korea, and Shinhan Capital among others.

The smartest plays in this space emphasise ease of control in addition to high-detail data. Nearthlab's differentiation gambit is an app that allows non-technicians to do inspections using any rudimentary commercial drone and a smart device.

"This will give them more opportunities to inspect," said Cathy Kim, communications lead for Nearthlab. "More inspections mean expanding turbine longevity by taking pre-emptive measures."

Beyond the grid

For many business models, even the disruption of energy production incumbents will look a lot like cooperative support. This is perhaps especially true in one of energy transition's most important sub-themes, the proliferation of DER.

The increasing adoption of rooftop solar, micro-wind, and distributed waste-to-energy installations is an urban phenomenon. And in jurisdictions with the highest DER penetration, the extra juice is putting significant pressure on poles and wires. Upgrading grids to accommodate the rise in DER would cost USD 1trn by 2050 in the US alone, according to Oliver Wyman.

Singapore's Elexsys Energy, which is backed by UK-based Amati Global Investors, is tackling this challenge on its frontline in Australia, where success in popularising rooftop solar is starting to overwhelm local grids.

Elexsys' solution is said to remove grid overload as a deterrent to further DER investment by increasing grid hosting capacity from decentralised power sources from 20-30% to 100%. This is achieved by tapping reactive power, which essentially represents the unused capacity in any electrical circuit.

Reactive power is a footnote in the physics of electricity and traditionally described by academics as "unusable" current analogous to the foam of a beer. The most important lesson for investors and entrepreneurs in this example is in the willingness to go against the entrenched conventions of the status quo.

"The utility industry is ignoring DER because sending too much energy backwards into the grid causes curtailment and so it's non-bankable," said Richard Romanowski, co-founder of Elexsys. "There was very limited teaching about reactive power at university. It's built into every engineer not to really talk much about it because it's an un-useful part of electricity."

EaaS and DER trendlines are also intersecting off-grid in the form of microgrid providers like Singapore-based Canopy Power. Canopy, which was backed last year by the VC arm of French energy giant Total, helps businesses in remote locations across Southeast Asia and Oceania set up self-contained, on-site renewable power systems.

Canopy organises the procurement and installation of renewable energy production equipment, as well as project financing in cooperation with a European joint venture partner. It then provides subscription software for ongoing monitoring and maintenance.

Clients span the gamut of eco-resorts, plantations, and mines, with the common denominator being isolation and dependence of fossil-fuel generators. The company has also detected momentum in industrial capacity moving off-grid simply as a way of reducing energy costs. It expects to record up to 10x year-on-year revenue growth for the 12 months ending in July.

"The underlying cost of energy in diesel and other fuels is driving growth this year, and there's a general view in the market that this is going to continue for a while," said Sujay Malve, co-founder and CEO of Canopy. "Our customers would rather get a system in and pay it off in five years and then basically have free electricity."

Inclusion angle

In most of Asia, the more pertinent applications for distributed and pay-as-you-go energy concepts are related to improving lives at the bottom of the economic pyramid. India's KPay, an unfunded company that transforms household appliances from products into services, offers an interesting case in point.

KPay blends software and light hardware by helping manufacturers of everything from lamps to TVs outfit their products with technology for monitoring usage and charging end-customers according to their usage of the item. If the account is not paid, the appliance can't be turned on. Anyone with a feature phone capable of text messaging and access to a 2G cellular network can use the system.

A blockchain-enabled marketplace is in development that will allow KPay customers to trade unused electricity credits. This will be like the smart meter concepts in developed markets that allow homeowners with DER to monetise their excess electricity – but at the level of a single light bulb.

CEO Ravi Pittie, who also runs a rooftop panel and off-grid appliance maker called Agni Solar, observes that familiarity with developing economies is necessary to make this model work. Much of his early traction was in Africa, where similar EaaS players from Europe did not fully understand how to contend with low internet penetration.

"Most of our competitors developed the technology as IoT [internet-of-things], and my issue was, if the ‘I' doesn't exist, how does it work?" Pittie said. "Having years of experience selling solar products in India, we were clear on those pain points."

Future Energy Ventures' only Asian portfolio company, a peer-to-peer smart grid provider called SolShare, is pursuing similar ideas in Bangladesh. But the investor's continued focus on Europe is a reminder that environmental regulation and industry liberalisation – not social impact – are the primary drivers of digital energy development.

Earlier this week, the VC firm launched its latest fund with a target of EUR 250m (USD 253m) and hopes of onboarding more Asian strategic investors to help its portfolio companies expand into the region. Much of the thinking here is around a perceived rise in global public demand for all things energy transition, a potential new driver of start-up creation.

"There's really something special happening which could create a huge new market," Lozek said. "You need to ask yourself why you don't have an electric car or a heat pump or any kind of energy transition instrument at home, because we are the energy transition. There's no one else doing it but us, and it starts with the products."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.