Varde Partners

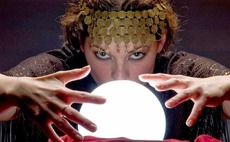

The crystal ball: Predictions for 2020

Industry experts weigh in as a range of macro factors promise to reshape markets across the region. Political, demographic, and scientific variables loom large

PE-owned Latitude cancels Australia IPO

Australia and New Zealand consumer lending business Latitude Financial has abandoned plans for an IPO that would have facilitated partial exits for its private equity owners.

PE-backed Latitude targets up to $946m in Australia IPO

KKR, Värde Partners and Deutsche Bank plan to make partial exits through an IPO of Australian consumer lending business Latitude Financial, which is expected to raise as much as A$1.4 billion ($946 million).

Global credit: Speed or scale?

The winners from a widely anticipated shakeout in global credit markets will be defined by different qualities. Direct lenders expect size to be a decisive factor, while distress players prioritize nimbleness

Asia-based Ilfryn Carstairs to become co-CEO of Värde

Ilfryn Carstairs (pictured), Singapore-based CIO of global alternative investor Värde Partners, has been named CEO. He will share the role with George Hicks, the incumbent and co-founder of the firm.

GA, Värde cancel planned investment in India's PNB

General Atlantic and Värde Partners have terminated a planned INR18.5 billion ($267 million) investment in PNB Housing Finance, the publicly listed mortgage subsidiary of India’s Punjab National Bank (PNB).

General Atlantic, Värde invest $267m in India's PNB

General Atlantic and Värde Partners have invested INR18.5 billion ($267 million) in PNB Housing Finance, the publicly listed mortgage subsidiary of India’s Punjab National Bank (PNB).

Värde collects $400m for debut Asia credit fund

Värde Partners has closed its debut Asia-focused credit fund with approximately $400 million in commitments. The vehicle launched about six months ago with a target of $250 million.

Indian NPAs: Solvency strikes

With a series of highly publicized bankruptcy proceedings, government efforts to rein in India’s non-performing assets may finally be paying off. Investors expect a wave of turnaround opportunities

Deal focus: Värde wants a piece of India's $200b problem

Värde is tackling what it sees as a massive opportunity set in the Indian distress market by partnering up with local investor Aditya Birla Capital

Australia distress: The luxury of time

Two pieces of legislation – one enacted and the other pending – are expected to facilitate corporate restructuring in Australia. It remains to be seen how turnaround investors take advantage of this